The $2.7 billion acquisition will give Roche access to Carmot's R&D portfolio, which includes clinical-stage incretins with first-in-class potential for the treatment of obesity in patients with and without diabetes. In addition to the initial purchase price, Roche has committed to pay up to a further $400 million based on the achievement of certain milestones.

Carmot's lead asset, CT-388, is a Phase II-ready dual GLP-1/GIP agonist with first-in-class potential for the treatment of obesity and its co-morbidities. Injected once a week, it could be used alone or in combination with other treatments to improve weight loss and be extended to other indications. Carmot's portfolio also includes CT-996, a once-daily oral small-molecule GLP-1 receptor agonist currently in phase 1, and CT-868, a once-daily injectable dual GLP-1/GIP agonist in phase II, for the treatment of overweight and obese type 1 diabetes patients.

The transaction, which remains subject to expiration or termination of the waiting period under the Hart-Scott-Rodino Act and other customary closing conditions, is expected to close in the first quarter of 2024.

A stepping stone to a colossal market

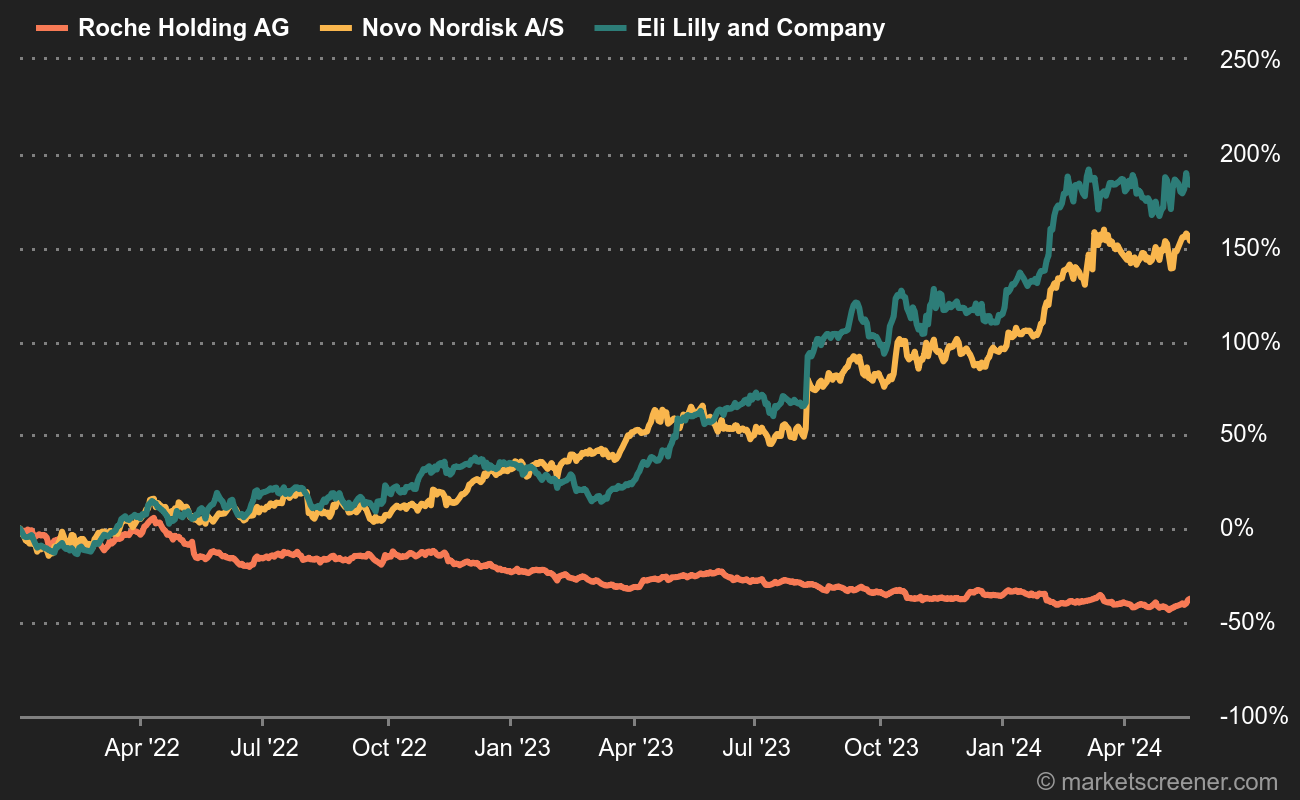

"Roche is gaining a foothold in the obesity market, which is currently booming," stresses AlphaValue analyst Abhishek Raval. If Novo Nordisk and Eli Lilly have a head start, the market is colossal. It is set to grow from around $3-4 billion in 2022 to $100 billion over the next decade, according to some market players, notes Raval, who believes this could be an inflection point for the Swiss laboratory, which has been rather under the radar for some time.

With anti-obesity treatment vs. without anti-obesity treatment

At Vontobel, Stefan Schneider sees the acquisition as a great opportunity for Roche, provided, of course, that the final steps are taken and the candidates paid a high price are proven to be effective.

"The Phase I data for Carmot's lead asset are interesting, albeit early, but we think the combination potential with Roche's muscle preservation candidates was probably a key attraction of the acquisition", explains Jefferies healthcare analyst Peter Welford.

By

By