The merged company is expected to add 700,000 barrels per day of oil and gas production within four years of the deal closing, to 2 million barrels per day.

The oil major’s CEO Darren Woods has long advocated for a slow transition to renewable energy that would see oil and gas as the main component of the world’s energy mix until at least 2050. In an interview with CNBC last year, he said that an abrupt transition to renewable energy will cause society to “pay a high price” and warned against a government policy that fails to balance the current demand for affordable energy with the need for lower emissions. He noted that underinvestment in the oil and gas industry correlates to higher prices.

A risky bet

Woods’ vision clashes with that of the International Energy Agency, which forecasts that global demand for fossil fuels will peak before 2030. The agency also estimates that demand for those fuels must fall by a quarter by the end of this decade if governments are to limit global warming to 1.5 degrees Celsius above pre-industrial levels.

However, the Permian Basin might not lose its popularity anytime soon with US authorities and oil majors because of its low cost to extract oil and gas. Unless it runs out of drilling locations, which is a likely possibility, according to experts.

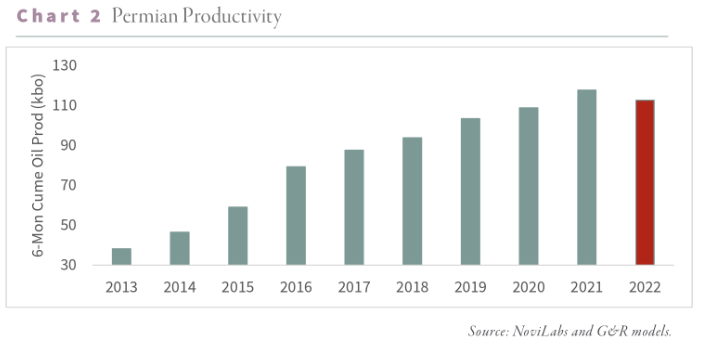

In a new note, Research firm Goehring & Rozencwajg writes that the basin could peak within the next twelve months. “The implications will be as profound as when United States oil production peaked in 1970, starting a chain of events ultimately sending prices up five-fold over ten years,” it said. If the firm is correct, this could be a huge blow to Exxon and its acquisition policy.

Source: Goehring & Rozencwajg

"The oil shales are running out of Tier 1 inventory," Bryan Sheffield, founder of energy investors Formentera Partners and Scott Sheffield's son, told Reuters. "Something has to change strategy-wise," he added.

In any case, Exxon’s strategy has paid off so far. It managed to exit a period of deep losses and huge debts by slashing costs and selling assets. Of course, it also benefited from the higher oil prices following Russia’s invasion of Ukraine, and put aside some $30 billion in cash in anticipation of deals, according to analysts. It remains to be seen if its latest bet will pay off...

By

By