This analysis was made by the Global Times on Saturday, less than a month after the US tightened its rules on the sale of high-end artificial intelligence chips to China. American restrictions on chips, designed to prevent China from acquiring advanced American technologies to bolster its military, are "not only harmful to China's interests, but also to those of the United States", according to the newspaper.

SemiAnalysis, a newsletter specializing in the semiconductor industry, had previously revealed that Nvidia was planning to launch new artificial intelligence chips specifically dedicated to the Chinese market, which could be unveiled on November 16. Called HGX H20, L20 PCIe and L2 PCIe, they would incorporate most of Nvidia's new functionalities, but some computing capacities would have been reduced.

The rules of the game change regularly

Last month, Nvidia, whose graphics processing units (GPUs) dominate the artificial intelligence market, announced that new U.S. export restrictions would block sales of two high-end AI chips, the A800 and H800, which it designed for the Chinese market last year to comply with previous export rules.

The new rules limit the computing power a chip can pack into a small package. They provide for what analysts call a "gray zone", in which chips could still be allowed to be shipped to China, but would require a license.

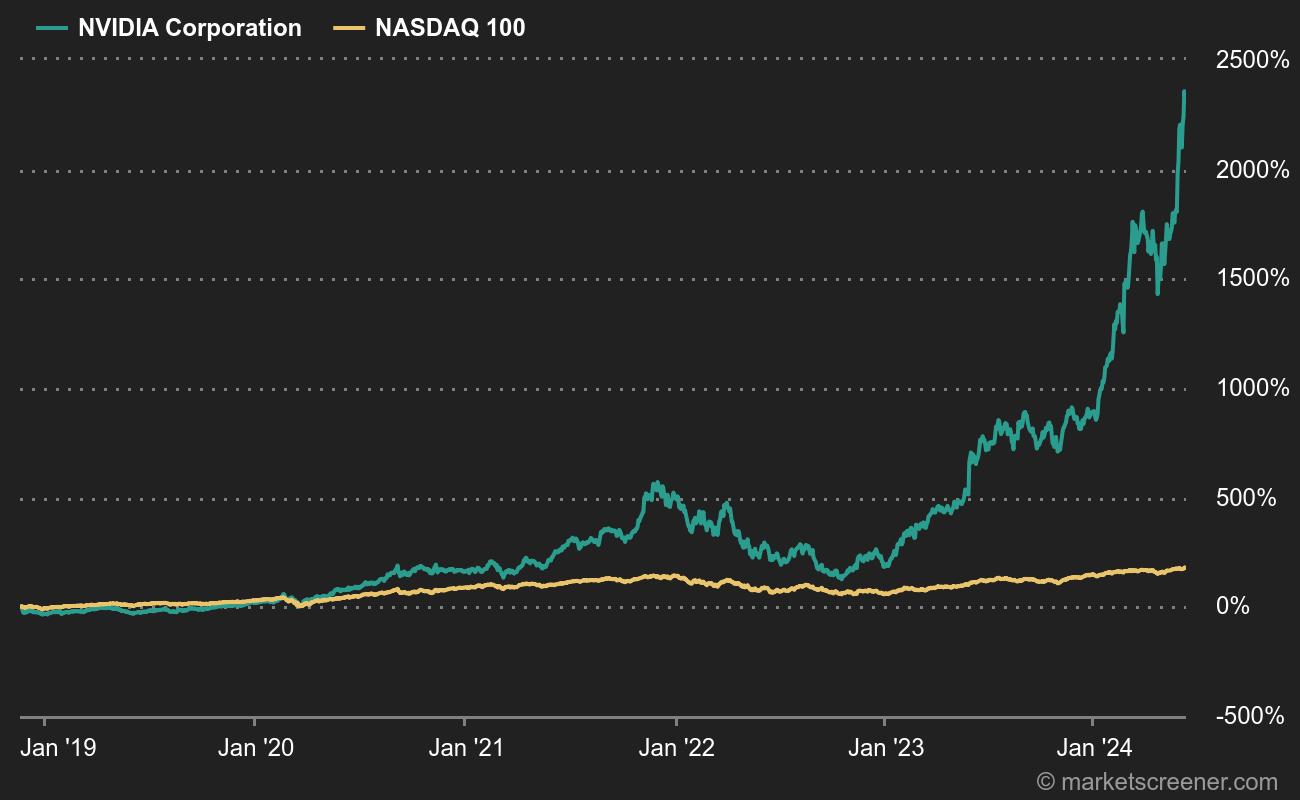

Nvidia's surge is measured by the Nasdaq 100, a rather complicated index to beat...

Nvidia has been a little battered on the stock market since its August peak of USD 502. But the stock has rebounded strongly in recent sessions, and is now within reach of its record high, trading at 483 USD.

Analysts remain extremely keen on the stock, with 40 positive opinions out of 53 recommendations, and an average target price of 641 USD (range 439 to 1100 USD).

By

By