Block 1: Essential news

- Sam Bankman-Fried to remain in prison

Former FTX CEO Sam Bankman-Fried's application for bail was flatly refused by the Court of Appeal this week, not least because of his repeated offences while on parole. Convicted on seven counts, he faces a maximum sentence of 110 years and will remain in prison until sentenced in March 2024. His attempts to suborn witnesses, Ryne Mille, the former general counsel of FTX US, and Caroline Ellison, did not work in his favor.

- HTX hack: $85 million evaporated

HTX, a cryptocurrency exchange platform, suffered a major cyberattack this week, resulting in the theft of over $85 million. Justin Sun, founder of the TRON blockchain and spokesperson for HTX, confirmed the incident, and assured that all losses would be covered by HTX, which has temporarily suspended all withdrawals and deposits. The attack, potentially due to a private key leak, affected the Heco bridge, used for token transfers. Although HTX has already repaid losses from a previous incident, doubts remain about its security and ability to prevent future attacks.

HTX and Heco Cross-Chain Bridge Undergo Hacker Attack. HTX Will Fully Compensate for HTX's hot wallet Losses. Deposits and Withdrawals Temporarily Suspended. All Funds in HTX Are Secure, and the Community Can Rest Assured. We are investigating the specific reasons for the hacker...

- Fidelity enters the Ethereum ETF race

Fidelity has filed an application with the SEC to launch a spot Ethereum ETF (ETH), joining other major companies such as BlackRock and VanEck. The product, which would be the seventh of its kind filed with the SEC, aims to offer direct exposure to the ETH price, in response to the lack of spot ETFs in the US. This news had no direct effect on the ether price.

- BTC miners at the Polish Supreme Court

Bitcoin (BTC) mining equipment has been discovered hidden in the ventilation ducts of the Polish Supreme Court in Warsaw, exploiting electricity at taxpayers' expense. The case was revealed by an ex-employee of a maintenance company, leading to the termination of the contract with this company and the dismissal of two employees. These mining machines, operating in secret, generated "significant energy costs" for the institution. This case is part of a wider context in which BTC mining equipment is illegally installed to take advantage of "free" electricity.

Block 2 : This week's cryptic analysis

This week the US Department of Justice (DOJ) reached a landmark settlement with Binance, the world's largest crypto-currency platform.

Binance has agreed to pay a substantial fine of $4.3 billion for violations related to money transfer laws and US sanctions. This agreement has led to an unprecedented organizational change within Binance. CEO and founder Changpeng Zhao, often nicknamed "CZ", was forced to step down after establishing the company in 2017.

Despite fears of crypto-investor panic following the announcement, data provided by DefiLlama indicates that since November 21, when the deal was announced, withdrawals at Binance have jumped to $1.15 billion.

DefiLlama

However, the platform appears to be financially resilient. Binance's latest "proof of reserves" report, a kind of unofficial audit that provides an overview of the platform's holdings, shows that it has assets worth around $65 billion. DefiLlama estimates the figure to be slightly higher, at $67.4 billion.

If these documents are to be believed, Binance's financial health is further underlined by the fact that it is over-collateralized for several of its main assets, such as Bitcoin (BTC), Ether (ETH) and Tether (USDT). This means that the platform's net balances exceed the amounts owed to its customers, theoretically indicating a solid financial buffer. In other words, if all Binance customers withdrew all the bitcoins they owned, the platform would still have bitcoins in reserve. At least, that's what this evidence of reserves indicates.

Zhao's departure as CEO is a momentous event for the company. More than a figurehead, Zhao was regarded as Binance's visionary leader, both by employees and by much of the crypto community. Known for his communication skills and use of social media to engage with the community, Zhao often managed to defuse negative situations with a simple tweet. He often tweeted a single number: "4". This number represented his four principles of ignoring "FUD" - fear, uncertainty and doubt - and staying positive.

Will try to keep 2023 simple. Spend more time on less things. Do's and Don'ts.

— CZ 🔶 Binance (@cz_binance) January 2, 2023

1. Education

2. Compliance

3. Product & Service

4. Ignore FUD, fake news, attacks, etc.

In the future, would appreciate if you can link to this post when I tweet "4". 🙏

His ability to remain positive in the face of adversity was a valued feature of his tenure at Binance.

On X, ex-Twitter, Mr. Zhao returned to his decision to resign, acknowledging his mistakes and accepting his responsibility. He stressed that his resignation was in the best interests of the Binance community, the company and himself.

Today, I stepped down as CEO of Binance. Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself.

— CZ 🔶 BNB (@cz_binance) November 21, 2023

Binance is no longer a baby. It is…

Zhao personally faces a considerable financial burden, with civil and criminal penalties amounting to $200 million. For a cryptocurrency pioneer whose fortune hovers around $15 billion, this penalty, while substantial, is manageable to settle the charges of a coordinated investigation involving the DOJ, CFTC and two law enforcement departments under the Treasury Departments, FinCEN and OFAC.

On the other hand, beyond the financial aspect, Zhao could spend the next 18 months to 10 years in a U.S. federal prison for the charges against him, notably for allowing Binance to operate without adequate anti-money laundering programs. Sentencing is scheduled for next February. Perhaps he'll find himself cellmates with Sam Bankman-Fried.

Binance's response to these changes was swift and strategic. The company appointed Richard Teng, previously head of Binance's regional markets, as CEO. Teng, who joins the company in 2021, had already been tipped as a potential successor to Mr. Zhao. His rapid promotion helped maintain stability and order within the company during this transition period.

Finally, Yi He, co-founder of Binance, head of customer service and rumored romantic partner of Zhao, is expected to continue in her role. Her position, which encompasses sales, marketing and branding, will be crucial to Binance's future without Zhao. Despite Zhao's mandatory absence from Binance operations for at least three years, in accordance with DOJ stipulations, He's continued presence could constitute a vital link between the company and Zhao, who remains its largest shareholder.

Finally, in his farewell letter to Binance employees, Zhao indicated that he did not intend to become CEO again, and that he would devote himself to investing in startups once this case was behind him. On a more general note, Binance is now ready to show its credentials and get back on track with US regulations.

Exclusive: Binance founder Zhao Changpeng CZ issued an internal letter saying "I will have to deal with some pain, but will survive", quoting Star Trek (2009) , "l need everyone to continue performing admirably". pic.twitter.com/m9w4hywIPm

— Wu Blockchain (@WuBlockchain) November 22, 2023

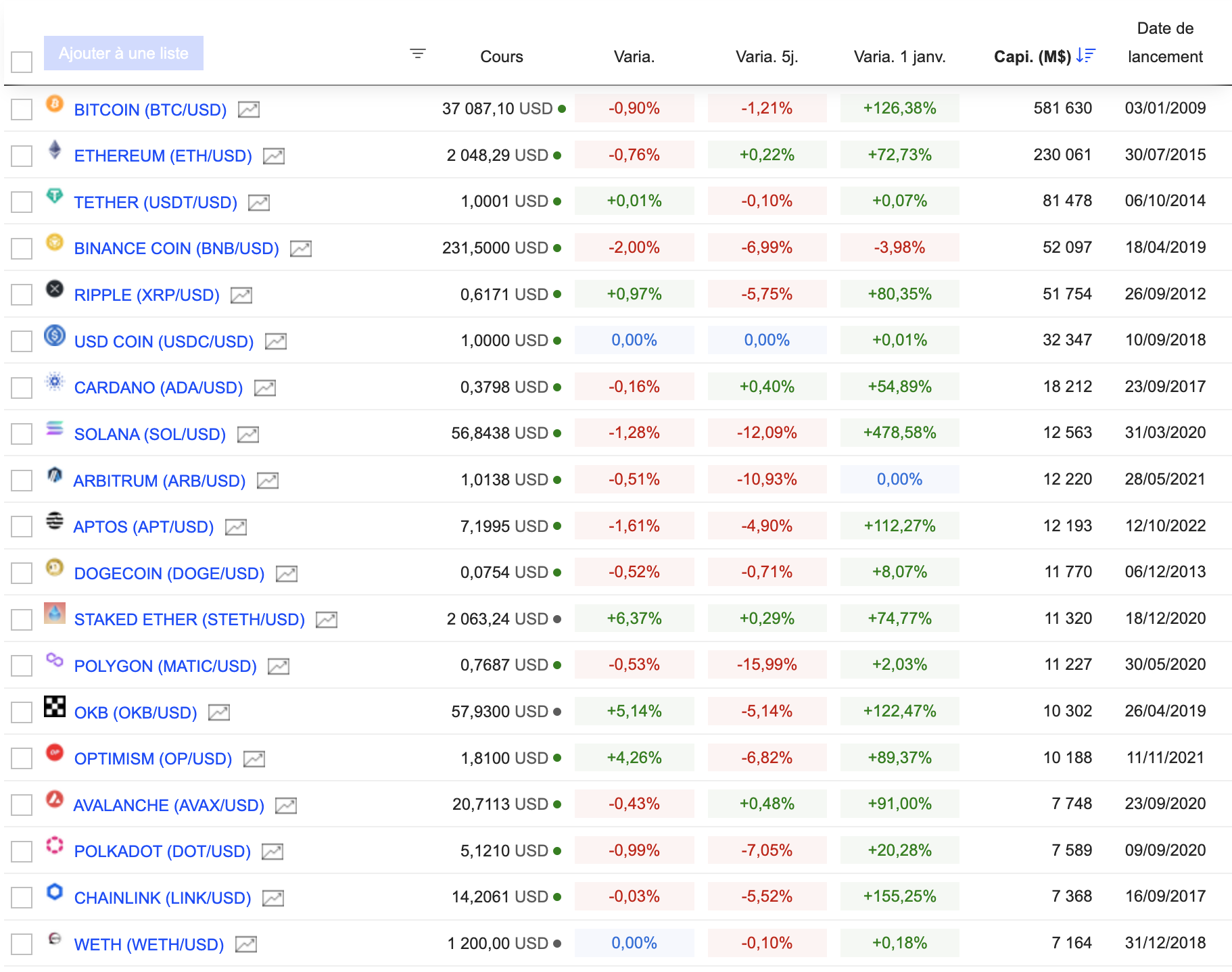

Block 3 : Gainers & Fallers

Block 4 : To read this week

CZ has left Binance, SBF is in jail. Crypto is about to get boring (Wired)Satoshi is black(Wired)

Une saga Binance touche à sa fin (The Information)

By

By