|

|

| This week's gainers and losers |

Top gainers : Micro Focus (+83%): This week's top pick. The British software company, which offers a range of business management tools, has agreed to be acquired by the Canadian Open Text for almost twice its stock price. Snowflake (+27%): One of the rising stars of U.S. technology reported better-than-expected quarterly results. The cloud data management specialist got an unexpected boost as, at the same time, Salesforce and Splunk's numbers, released on the same day, disappointed. Aveva (+22%): Schneider Electric was forced to confirm that it is once again considering buying out the British company's minority shareholders, after the information leaked to the press. This is an old story that comes up regularly, but it seems more and more obvious that the French company has no real interest in keeping its subsidiary listed. CF Industries (+14.28%) : CF Fertilisers, a subsidiary of CF Industries Holdings, has announced plans to temporarily halt ammonia production at its Billingham complex because it is "uneconomic" at current natural gas and carbon prices. It intends to import ammonia in order to keep its ammonium nitrate and nitric acid upgrading plants operational. Apa Corporation (+10.53%) : The hydrocarbon exploration and production specialist announced a first discovery in Block 53, offshore Suriname. Investors are delighted with this discovery and the share price is up. Dollar Tree (-11%): The discount chain has revised downwards its annual forecasts, both on sales and results. The company is affected by the economic slowdown and inflation. At the same time, the CFO will step down. |

|

| Commodities |

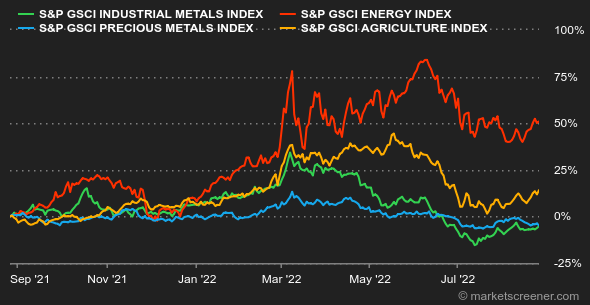

| Energy: OPEC's statements paving the way for a potential production cut, as well as the progress of talks on the Iran nuclear deal, have driven up and then down oil prices. These two catalysts are clearly being watched closely because they have a direct impact on the direction of global supply. Brent is currently trading near USD 100 per barrel, while WTI, the US benchmark, is trading around USD 93. WTI's discount to Brent facilitates US crude oil exports as well as oil product exports. In Europe, where the Dutch TTF has reached a new high of EUR 320/MWh, the pressure on natural gas is not easing. Metals: With the exception of lead, which fell back to USD 1976 per ton this week, industrial metal prices rose this week. On the LME, copper is trading around USD 8150. According to the International Copper Study Group's (ICSG) most recent monthly report, the copper deficit increased from 34,000 to 66,000 tons between May and June. Gold has stalled and is currently trading at around USD 1,750 per ounce. Agricultural products: The drought is affecting more than just Europe. Heat waves are also affecting the United States and China, potentially reducing yields of water-intensive crops such as wheat and corn. Corn and wheat are trading at 792 and 655 cents per bushel in Chicago, respectively. |

|

| Macroeconomics |

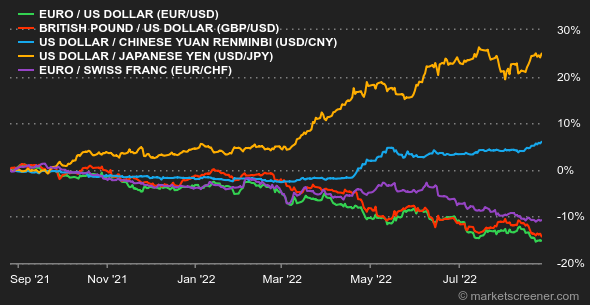

| Atmosphere: Don't dream. Those who expected the Fed to make pro-market statements in Jackson Hole on Friday will be disappointed. Despite the first signs of easing in inflation and somewhat weak macroeconomic data in the United States, Jerome Powell is not relaxing his guard and continues to emphasize that rate hikes are still required to keep prices in check. We've gone from doing whatever it takes to keep the economy afloat to doing whatever it takes to slow it down, which is painful. Soaring energy prices pose a systemic risk to European political and monetary authorities. The PMI indicators released this week indicate that the fall will be difficult. Rates: In the United States, the yield curve is still inverted, with 10-year debt paying 3.02% compared to 3.20% for six-month debt. The prospect of interest rates remaining high for a longer period than expected, as Powell suggested in Jackson Hole, raises concerns about a prolonged period of economic slowdown. In Europe, the German Bund is yielding 1.38%, the French OAT is yielding 2.01%, and the Italian BTP is yielding 3.68%. Currencies: The energy crisis in Europe, combined with the Fed's stance, pushed the euro below parity with the dollar at the start of the week. The euro eventually recovered to around USD 1. Finally, the Dollar Index, which compares the US currency to six benchmark currencies, lost some ground from the previous weekend while remaining high. EUR/GBP is at 0.8495, while EUR/CHF is at 0.9633. Cryptocurrencies: Bitcoin has continued its downward trend from last week, falling more than 3% since Monday and hovering around $21,000 at the time of writing. Risky assets are struggling to regain sustainable ground in a still tense macroeconomic context, particularly one orchestrated by central banks and their fight against hyperinflation, especially since crypto-currencies are still very sensitive to macroeconomic announcements. As a result, institutional, professional, and retail investors appear hesitant to return to the volatile digital asset market. Calendar: Germany will release its preliminary August inflation rate on Tuesday. The following day, France and the Eurozone as a whole will be in the spotlight. In the United States, all eyes will be on the August unemployment figures, which will be released on Friday. No, you are not hallucinating; there is no central bank line this week. But no worries, some Fed members will continue to speak in the coming days. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By