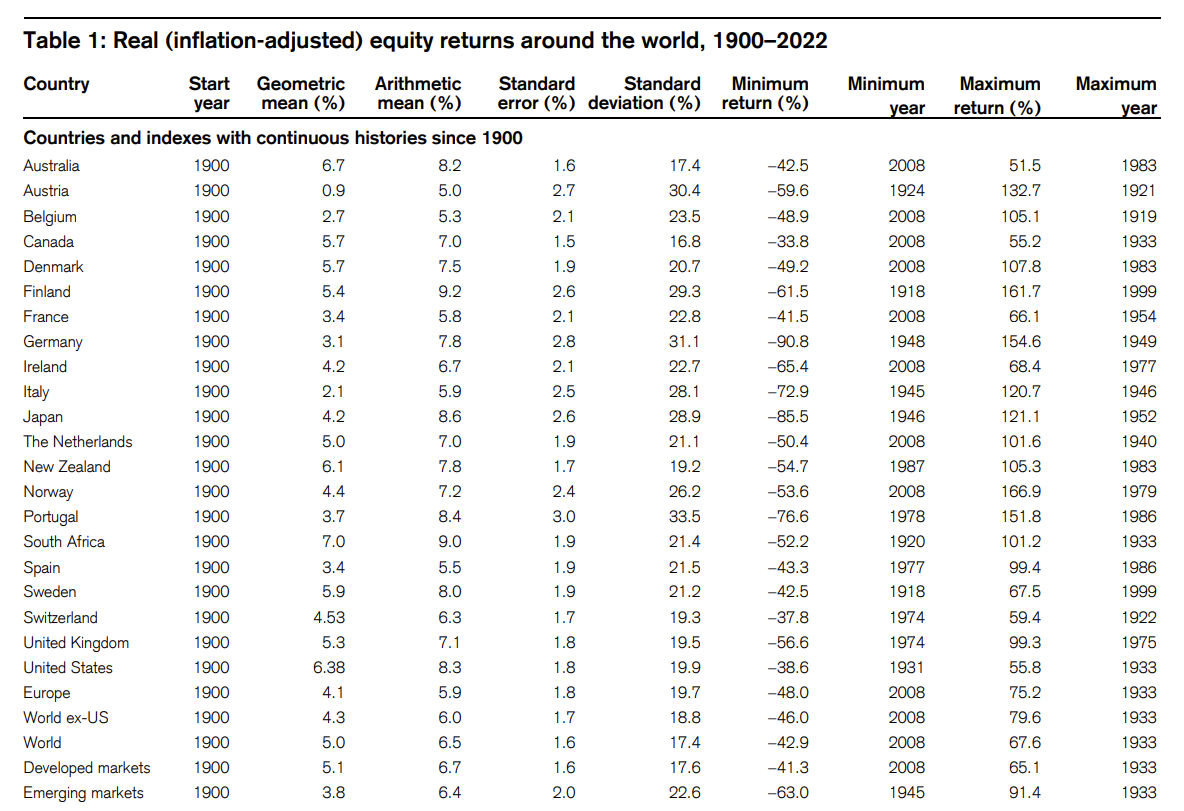

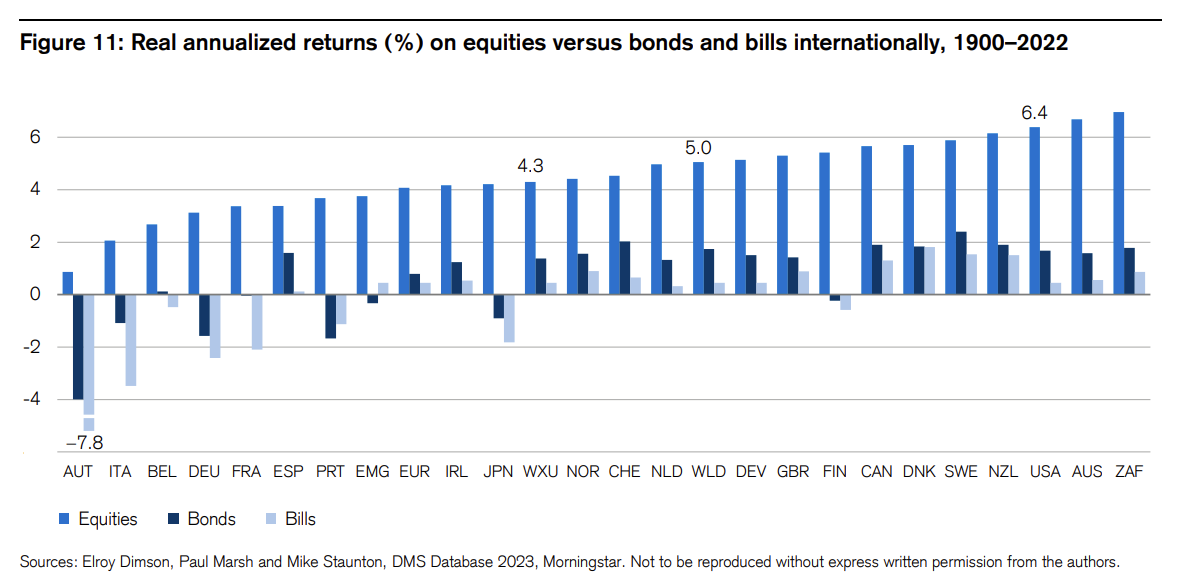

According to the Credit Suisse Global Investment Returns Yearbook 2023, since 1900, South Africa has been the best-performing stock market in terms of real USD, with an annualized real return (taking into account the loss of purchasing power due to inflation) of 7.0%, followed very closely by Australia with 6.7% and finally the United States, which completes the podium with an annualized return of 6.4%.

Source: Crédit Suisse

But let's not stop at this somewhat simplistic observation, which consists of selecting the best-performing markets over the long term and hoping they continue on the same trajectory. Let's look at a more recent period, the last decade for example. Stock markets in 1900 and 2022 have little in common, if only in terms of sector allocation. The past success of mining companies, with a strong presence in Australia, New Zealand and South Africa, has largely faded. Today, other sectors have taken up the slack, notably the technology sector, which accounts for 22.1% of the MSCI ACWI global index of developed and emerging countries. In a way, technology companies are the new growth drivers of the mining companies of the last century. They also explain the outperformance of technology-rich markets such as the USA.

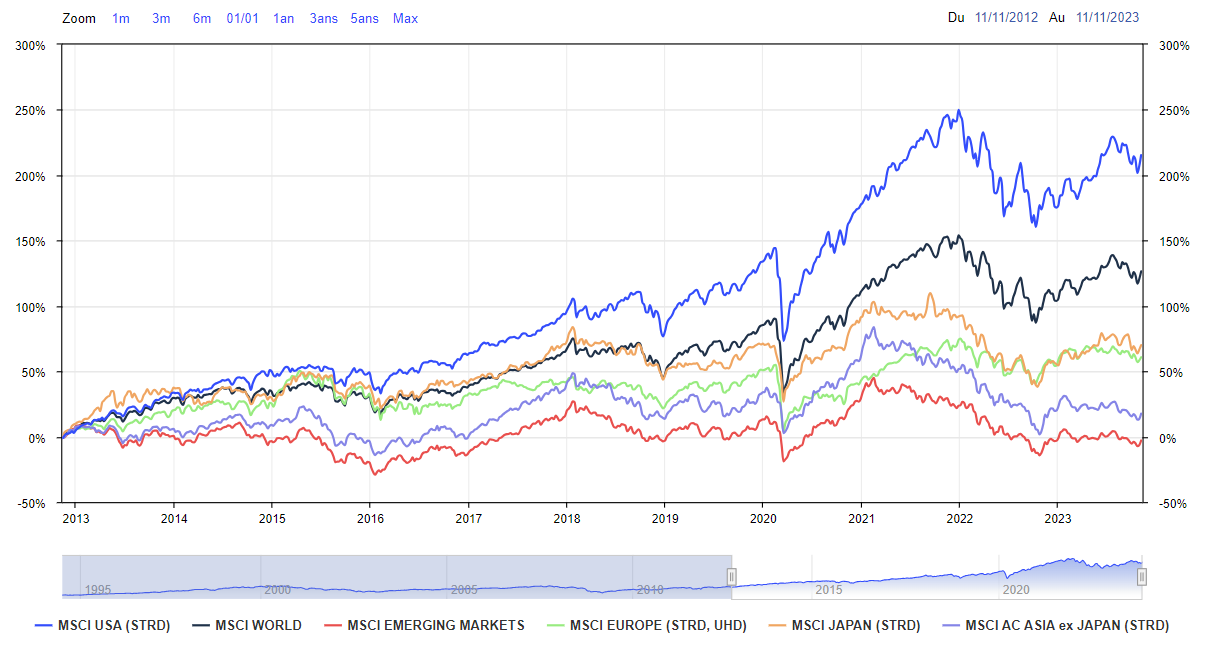

If need be, I'd like to compare the main MSCI indices over the last 10 years. The MSCI USA far outperforms all other countries and regions. It has been the best-performing market over the past 10 years. It now makes up 70% of the MSCI World and 62% of the MSCI ACWI.

Source: MarketScreener

However, other geographic zones may be more interesting over a more current timeframe.

A study by Dede Eyesan, founder and manager at Jenga Investment Partners, goes a step further in analyzing performance by region. Mr. Eyesan studied companies with a stock market performance in excess of 1000% over the last decade (May 31, 2012 to May 31, 2022), i.e. a CAGR (compound annual growth rate) of 27% per annum. The idea is no longer to find a market that is performing well overall, but to find fertile ground for multibaggers, those companies that have seen their share price multiply by 2, 5, 10 or even 100 times. Let's see if we can learn from this study to find high-performing companies in the future, and invest in the countries that provide the most multibaggers.

- Are some countries more attractive than others?

Of the 55,000 companies listed in May 2012 (with a market capitalization in excess of $50 million), 446, or 0.8%, have a stock market performance in excess of 1000% ten years later. In terms of geographical distribution, 59% of multibaggers are Asian. India leads the way with a total of 91 companies, followed by the USA with 60 and Japan with 49.

Let's take a look at the geographical distribution of these stocks by country:

.png)

Does this mean you're more likely to find a +1000% in India, the USA or Japan? Not really. These are markets rich in listed stocks. To date, we have listed 4762 Indian companies, 10941 American companies and 4092 Japanese companies.

Countries where you're most likely to find multibaggers:

.png)

Let's look at the podium of countries with the most multibaggers (by +1000%) relative to the size of their listed market:

- India weighs in at 4.6% of the global stock market (in terms of the number of companies listed in 2012 with a market capitalization of over $50 million), but 20.4% of the 446 companies identified, or 91 stocks. If you chose an Indian company at random in 2012, you had a 3.6% chance of coming across a stock that had achieved a stock market performance of +1000% ten years later.

- Sweden accounts for 1.5% of the global stock market (in terms of the number of companies listed in 2012 with a market capitalization of over $50 million), but 4.5% of the 446 companies identified, or 20 stocks. If you chose a Swedish company at random in 2012, you had a 2.4% chance of coming across a stock that achieved a stock market performance of +1000% ten years later. Generally speaking, Europe occupies an important place in the ranking, with 20.3% of the sample compared with 12% of the number of shares listed worldwide.

- Israel accounts for 1.3% of the global stock market (in terms of the number of companies listed in 2012 with a market capitalization of over $50 million), but 3.1% of the 446 companies identified, i.e. 14 stocks. If you chose an Israeli company at random in 2012, you'd have a 1.95% chance of coming across a stock that achieved a stock market performance of +1000% ten years later.

In view of this data, which I'm sure will come as a surprise to many of you, a few questions come to mind:

- Why is India ahead of the USA with 91 companies, i.e. 20.4% of the 446 identified?

- Why do Sweden and Israel have such a high percentage of successful companies, despite the small number of listed companies and the small size of their countries?

Let's try to understand the origins of these performances. Are there any explanations why these countries have a higher proportion of top-performing stocks?

Country n°1: India

India is the leading country in terms of the number of stocks, with 91 companies posting over 1000% performance. In fact, India outperformed North and South America combined, and was only two companies short of beating Europe.

If you're thinking that the last decade was exceptional in India's case, the researchers did the same experiment for the previous decade: India also came out on top over the period 2022-2012, with 21% of the sample.

If you're thinking that this success is due to India's high GDP growth, you'd be wrong too. Indeed, China and Japan have both experienced high GDP growth without their stock markets growing by an ounce. While India benefits from a rapidly growing population, an English-speaking and technically gifted workforce, among other macroeconomic tailwinds, the 91 companies' outperformance has much more to do with the macroeconomic landscape.

India dominates the consumer goods and staples sectors, with 38% representation. Companies such as Britannia Industries, Minda Industries, Trent Limited and Balkrishna Industries, which manufacture essential products, experienced significant growth. Indian textile companies such as KPR Mill, Garware Technical, Trident and Page Industries have also seen their margins widen over the years. They began by trading in textile raw materials, and gradually improved product quality, expanded their customer base and achieved economies of scale.

Companies such as Eicher Motors, Relaxo Footwears and Balkrishna Industries (BKT) have enjoyed exceptional growth. BKT, for example, has grown by 226,322% over the past 20 years. These companies have adopted different growth strategies and focused on niche markets.

India's industrial and basic materials sector has produced more multibaggers than the US basic materials, software, semiconductor and healthcare sectors combined. These companies, often run by the founding family, have evolved from years of trading in raw materials to manufacturing.

It has one of the largest IT services markets, with multinationals such as Tata Consultancy, Infosys and Wipro. These companies have evolved to offer more technical services and have acquired international peers to remain competitive on a global scale.

About 40% of the 91 companies saw their profits grow by more than 20% a year over the period. This is the main reason for the rise in share prices. Rising valuation multiples are the second most important explanatory factor.

Despite high valuations, Indian equities still offer investment opportunities. Many Indian companies are diversifying beyond the domestic market, creating more diversified revenue streams. It is therefore crucial to look at Indian companies beyond their face value and consider their potential for expansion.

- Country #2: Sweden

Sweden is also fertile ground for multibaggers. Sweden has a fairly rich listed market in terms of number of companies, surpassing that of France or Germany, despite having a much smaller population and GDP. But what interests us here is the quality of the companies and why so many fine stocks have performed so well. Well, there are two main reasons:

- Significant innovation

- Superior growth

Sweden, a land of innovation

Sweden is the second most innovative country according to the Global Innovation Index. In fact, the rate of spending on research and development (R&D) is the highest in Europe. Sweden has the ninth-best education system in the world. The country has always encouraged innovation, entrepreneurship and creativity. As early as elementary school, programming is taught and students are often encouraged to participate in projects in an open classroom environment. At university level, innovation and research are highly valued in all areas of study. This emphasis on innovation and creativity from an early age explains why some of Sweden's most successful technology companies were founded by student entrepreneurs.

Sweden's international growth strategy

To build competitive companies, innovation and a quality product are not enough. Companies need to measure up to their international counterparts, from sales to distribution, and successful Swedish companies have succeeded in doing just that. It's common for Swedish start-ups to compare themselves with their global counterparts right from the start.

Some people also credit the state with many business support initiatives because of its export-led economic objectives. One example is the creation of EKN, a Swedish export credit agency. It promotes Swedish exports by insuring the risk of non-payment in export transactions. This facilitates access to markets that may seem difficult. The Swedish government has also set up regional export centers that help companies obtain the right promotional and customer contact details within 24 hours.

- Country #3: Israel

Israel has a population of 9.6 million, an area of 21,000 km2 and a nominal GDP of $527 billion (in 2022). How could such a small country generate so many multi-baggers?

Israel, the start-up nation

Long considered an emerging country, Israel is now referred to as a start-up nation, or even a scale-up nation, so successful has it become on an international scale. In the space of 50 years, Israel's innovation ecosystem has become one of the most attractive, dense and productive on the planet. The government's proactive R&D policy, education (exposure to technology from childhood) and the promotion of risk-taking are key factors in Israel's success.

The nation is home to an ecosystem of over 9,000 start-ups, which raised a record $10 billion in 2020. The Hebrew state is the country with the most engineers per square meter, surpassing even the density of engineers in Silicon Valley.

The Israeli ecosystem is gaining in maturity, and stands out in several fields such as cybersecurity, artificial intelligence, intelligent mobility, digital health, agrotech and fintech.

Israeli start-ups are recognized on the international scene. Almost 90% of the capital invested in them comes from abroad. The United States accounts for 80% of all mergers and acquisitions, and around a hundred Israeli companies are listed on the Nasdaq Composite. These financial and strategic links put Israeli companies in direct contact with the global market.

Now ranked sixth in the Bloomberg Innovation Index, eighth in the US News and World Report, tenth in the Global Innovation Index and the country with the highest number of start-ups per capita, the Israeli ecosystem is characterized by a unique density: 809 per capita were invested in start-ups in Israel in 2020, compared with $302 in the USA, $58 in China and $41 in Europe.

This success has been built around a singular commitment on the part of the public authorities for almost 50 years. The introduction of the Yozma program in the 1990s contributed to the development of venture capital. There are numerous tax incentives for high-tech companies. Other measures, such as a culture of risk-taking and entrepreneurship, and the training of human capital (coding courses are offered as early as secondary school) are also conducive to this dynamism. The narrowness of the domestic market and Israel's "insularity" (in relation to its culturally, economically and politically discordant neighbors) also encourage start-ups to go international.

Israel, a restrictive environment

However, the Israeli ecosystem faces a number of challenges. The high-tech sector operates in a vacuum, and does not benefit the entire local population. Dependence on foreign funding is also a weakness. Indeed, while the average size of exits has increased in recent years, their earliness remains a source of concern.

Israeli innovation has been built in parallel with the self-sufficiency of this state, which since its genesis has sought to legitimize itself in the eyes of the international community: ensuring its security in a country surrounded by adversaries, growing crops in a hostile land, finding water in the middle of the desert. An incredible but true figure illustrates the need for the Hebrew state to be self-sufficient and to make defense a strategic domain: one in four start-ups worldwide that has raised funds in cybersecurity is based in Tel Aviv.

As you can see, the incubator that is Israel today was born of the state's need to compensate for its territorial weaknesses. A scattered state, with unclear borders shared with the West Bank, which is not unanimously supported by its neighbors and the international community alike.

Of course, past performance is no guarantee of future performance, nor is it constant over time. Nevertheless, the main countries mentioned (India, Sweden, Israel) are, in my opinion, still favorable breeding grounds for the expansion of listed companies.

By

By