The strategy team now led by Emmanuel Cau, who arrived from JP Morgan a few months ago, pointed out that the technology sector has been particularly affected by the deterioration in the trade-related economic climate and could benefit from any improvement on this front, even if all the accumulated concern will not evaporate instantly. It is difficult, indeed, not to share this analysis. But Barclays has more than one data in his bag.

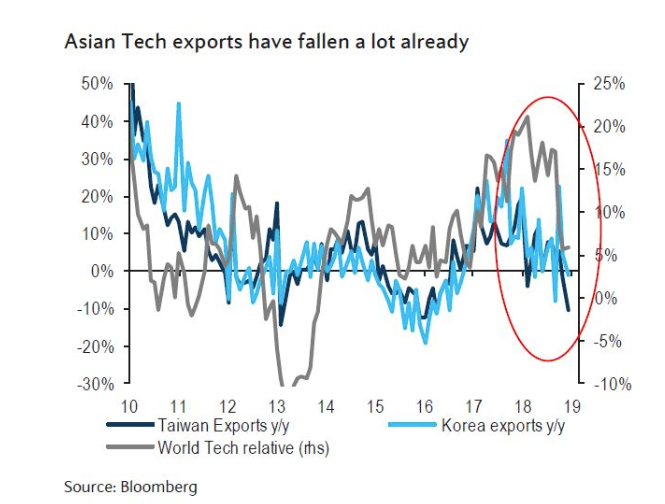

Let's start with the sector’s price earnings ratio (PER). The fall in technology stocks (worst sector performance in the second half of 2018) reduced valuation multiples to median levels (Figure 1). In parallel, the correction is already profound for Korean and Taiwanese players with an export that has declined significantly (Figure 2), while the indicator of new orders and stocks of PMI Tech is at a 5-year low. All this is happening in a context where expectations and prices are more in phase, even if the 2019 consensus still seems a little too generous.

Barclays is therefore shifting from underweighting to market weighting on European technologies. It does not expect the Sino-American dispute over technology and national security issues “to end any time soon”. In addition, it notes that the dismantling of the QE and the continued reduction of excess liquidity could weigh on the valuations of high-cost sectors such as technology. However, it believes that the valuation of the sector has improved significantly and that it already embodies a high level of uncertainty. The strategy team also believes that while the 4th quarter is complicated, the light is at the end of the tunnel. Analysts are generally more confident about software, which is an end-of-cycle segment, than about seedlings and computer equipment, which are however close to low points.

In the semiconductor sub-compartment, Barclays favors ASML (preferred value), STMicroelectronics, Dialog, Ams and IQE. In network equipment, the analyst prefers Nokia to Ericsson. In software, the bank finds interest in Atos, Avast, Evolution and Just Eat for the software and IT part, and Wirecard in payments. ASML (tomorrow) and STMicroelectronics (Thursday) will open the quarterly ball on the old continent.

By

By