Biography

Born in 1953, Terrence Smith grew up in East London, where he attended Stratford Grammar School, before studying history at University College Cardiff in 1974, where he won a first prize. He turned down an offer of a research fellowship to pursue a career in business.

He then had a classic early career in the City (London) banks - Barclays and UBS - where he learned the trade of equity analyst.

In 1990, a series of FTSE 100 companies went bankrupt. Clients of Mr. Smith, then head of UK corporate research at UBS, wanted to know why these companies had gone bankrupt despite posting apparently healthy profits. In response, Mr. Smith wrote a circular for analysts, showing that these companies had struggled with cash flow rather than profitability and, in some cases, had used deliberately misleading accounting techniques.

Smith's article, examining 12 of these techniques, was well received and led to a publishing contract with Random House. The book Accounting for Growth was then published. UBS asked Smith to withdraw the book from sale, which Smith and Random House refused to do. Terry Smith was fired from UBS.

The controversy helped propel the book to the top of the bestseller list - more than 100,000 copies sold - and gave Terry Smith a solid reputation as a manager.

In 2010, Mr. Smith founded Fundsmith, a London-based fund management company. By August 2023, this hugely successful asset management company had over £35 billion under management.

His investment philosophy

Terry Smith's investment philosophy is very similar to that of the Oracle of Omaha, hence his nickname "the English Warren Buffett". It can be summed up in three points: buy quality companies, don't overpay for them, and then do nothing. Terry Smith takes a long-term view of investing. He wants to buy and hold for a long time, at least as long as his investment thesis is not challenged.

Terry Smith seeks to acquire :

- high-quality companies capable of sustaining a high return on operating capital employed ;

- whose competitive advantages are difficult to replicate;

- that do not require significant leverage to generate returns;

- have a high degree of growth certainty through reinvestment of their cash flows at high rates of return;

- resilient to change, especially technological innovation;

- attractive valuations.

The Fundsmith manager also applies a number of self-imposed key principles (no-rules) to uphold his philosophy and maximize performance:

- No performance fees;

- No front-end load;

- Common sense investments;

- No leverage or derivatives;

- No short selling;

- No market timing;

- No index tracking;

- No trading;

- No hedging.

Smith frequently uses the Tour de France analogy to explain his long-term investment philosophy. He argues that there's no point in looking for a fund manager who can perform well in all market conditions, comparing them to the cyclists in the Tour de France, which "has never been won by a rider who has won every stage, and never will be". Like the Tour de France, investing is a test of endurance, and the winner will be the investor who finds a good strategy or fund and sticks with it".

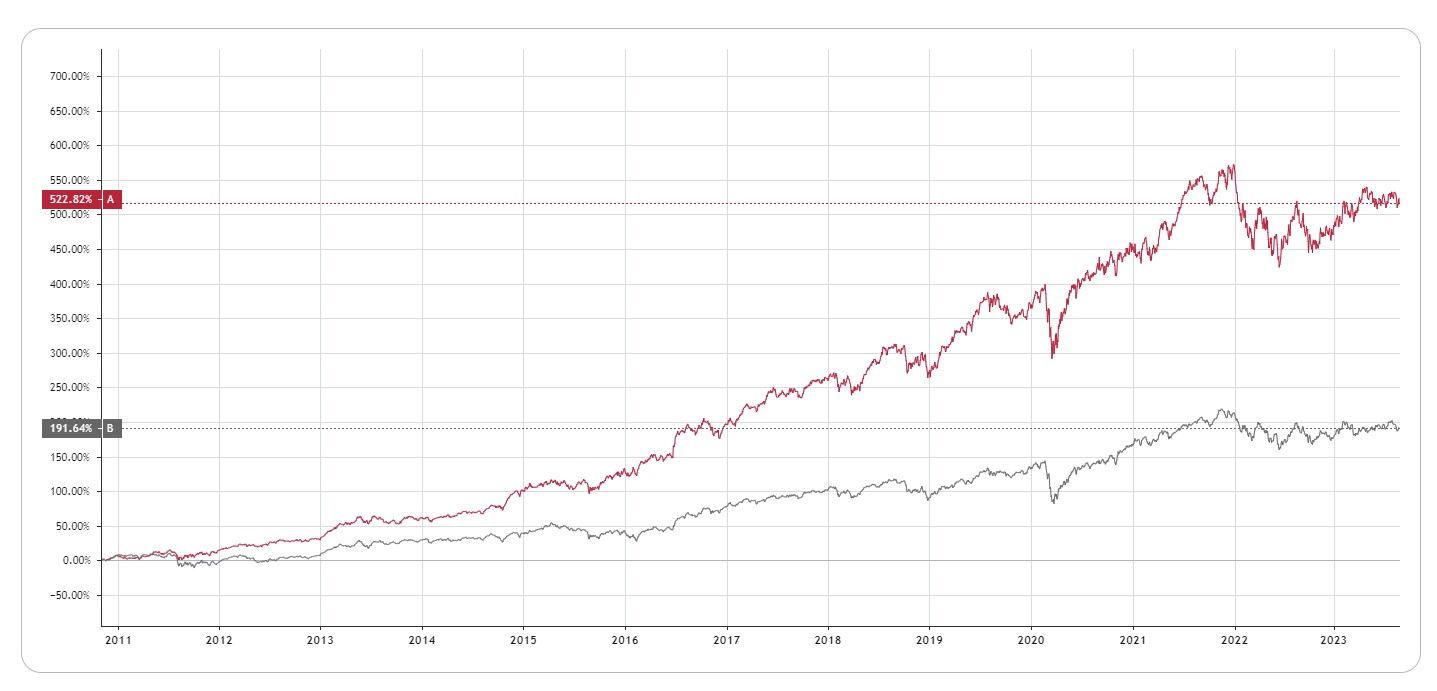

Our performance

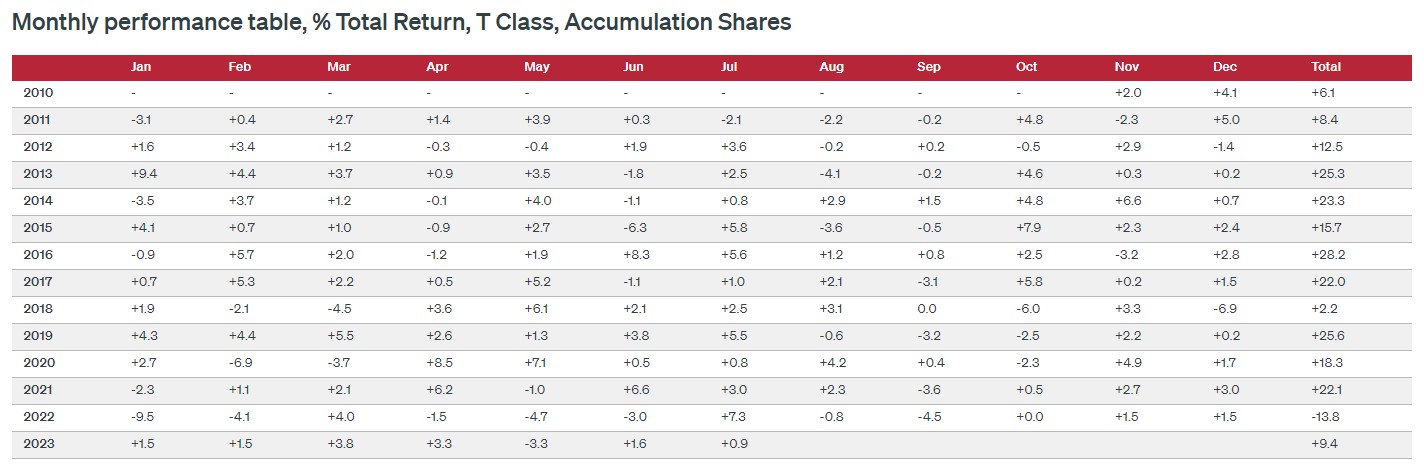

From its inception on November 3, 2010 to 08/25/2023, the Fundsmith Equity Fund T Acc (in GBP) has generated a total return of +522%, compared with just +191% for its benchmark. This gives a much higher return than the market, with a CAGR of 15.6% for the fund versus 9% for its benchmark.

Source : Fundsmith

Source : Fundsmith

The portfolio

.png)

True to his investment philosophy, his portfolio is made up of qualitative companies, often market leaders, with significant moats, such as Microsoft, L'Oréal, Novo Nordisk, LVMH, Meta Platforms, Stryker, Idexx Laboratories, Visa, McCormick, Philip Morris and others.

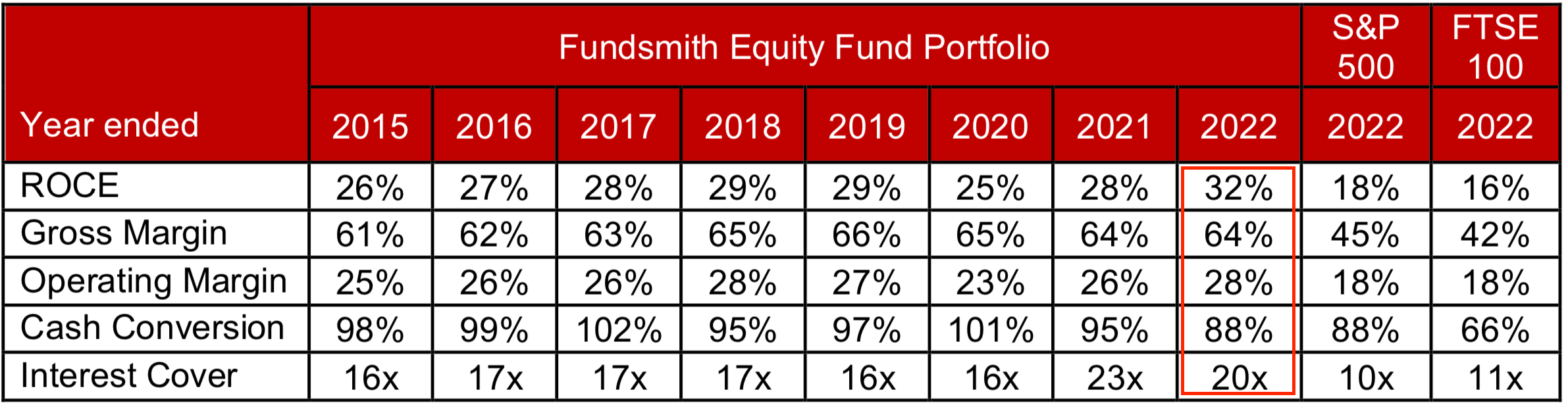

Terry Smith closely follows certain fundamentals when selecting and monitoring his positions. In particular, he uses ROCE (Return On Capital Employed), gross margin and operating margin (= EBIT margin) as well as the Interest Coverage Ratio (EBIT/Interest expense), i.e. profitability and solvency ratios. Of course, he also uses other data, but these five give us a good idea of which companies might be of interest to him in the future.

These top lines (only those weighing over 1% in his portfolio):

.png)

According to the latest presentation to investors, the average of his portfolio has :

- ROCE > 30%

- gross margin > 60%

- EBIT margin > 25%

- cash conversion >80

- interest coverage > 15x

Source: Fundsmith

So I took the time to look for companies that meet these five criteria and Terry Smith's requirements. Here are 7 companies that Terry Smith doesn't (yet) have in his portfolio that meet these criteria. I wouldn't be surprised to see at least one of these companies in his portfolio in the near future.

Here are a few of them:

.png)

By

By