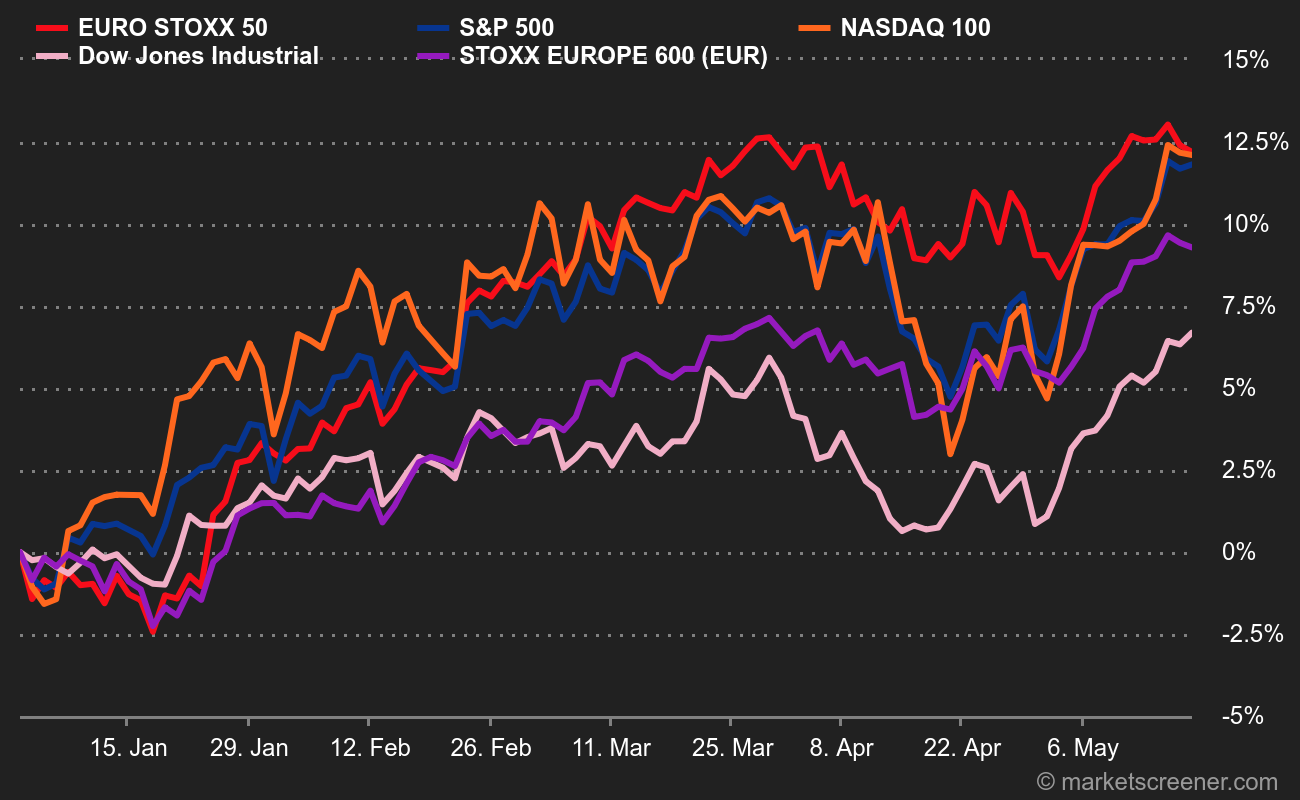

Euro Stoxx 50, champion 2024

The "little" European index, derived from its big brother the Euro Stoxx 600 and made up of the 50 biggest companies in the eurozone's main sectors, has the luxury of outperforming the three US giants (Nasdaq, Euronext and Kospi).ants (Nasdaq, S&P 500 and Dow Jones) since the start of the year, with growth of over 9%. A performance rare enough to merit a mention.

At the end of August 2023, the index gave France pride of place (nearly 42%), followed by Germany (26%), the Netherlands (around 13%), Spain and Italy (around 7% each), then Ireland, Finland and Belgium.

Since then, national weightings have changed significantly, notably due to the expansion of the Dutch ASML, which used to account for 8% of the index, compared with 10.3% today. The Finnish portion, represented solely by Nokia, has been reduced from 1.8% to 0.5%.

At the end of last summer, technology was the strongest sector, accounting for over 15% of the index, followed by consumer products and services (14%), industrials (13%) and banks (11%). The rest of the pool is made up of pharma, insurers, energy companies, automotive suppliers and manufacturers, chemical groups, and food and tobacco producers.

The index's lower weighting in artificial intelligence and tech-related stocks, compared to the Nasdaq or S&P 500 , has helped limit losses in recent months. Infineon 's slump (-21% since January 1) has been offset by the strength of ASML (+21%) and Adyen (+20%).

Conversely, the good health of European banks (+25% for Banco Santander, +41% for Unicredit, +28% for BBVA, +30% for Intesa Sanpaolo, +14% for ING groep), and French manufacturers (+14% for Schneider, +15% for Airbus, +29% for Safran) boosted the Stoxx 50. Last but not least, Mercedes (+18%), Ferrari (+21%), Adidas (+22%) and Hermès (+21%) made significant contributions.

The lower valuation of European equities compared to US stocks and the prospect of ECB rate cuts also made them particularly attractive to investors on the continent and beyond.

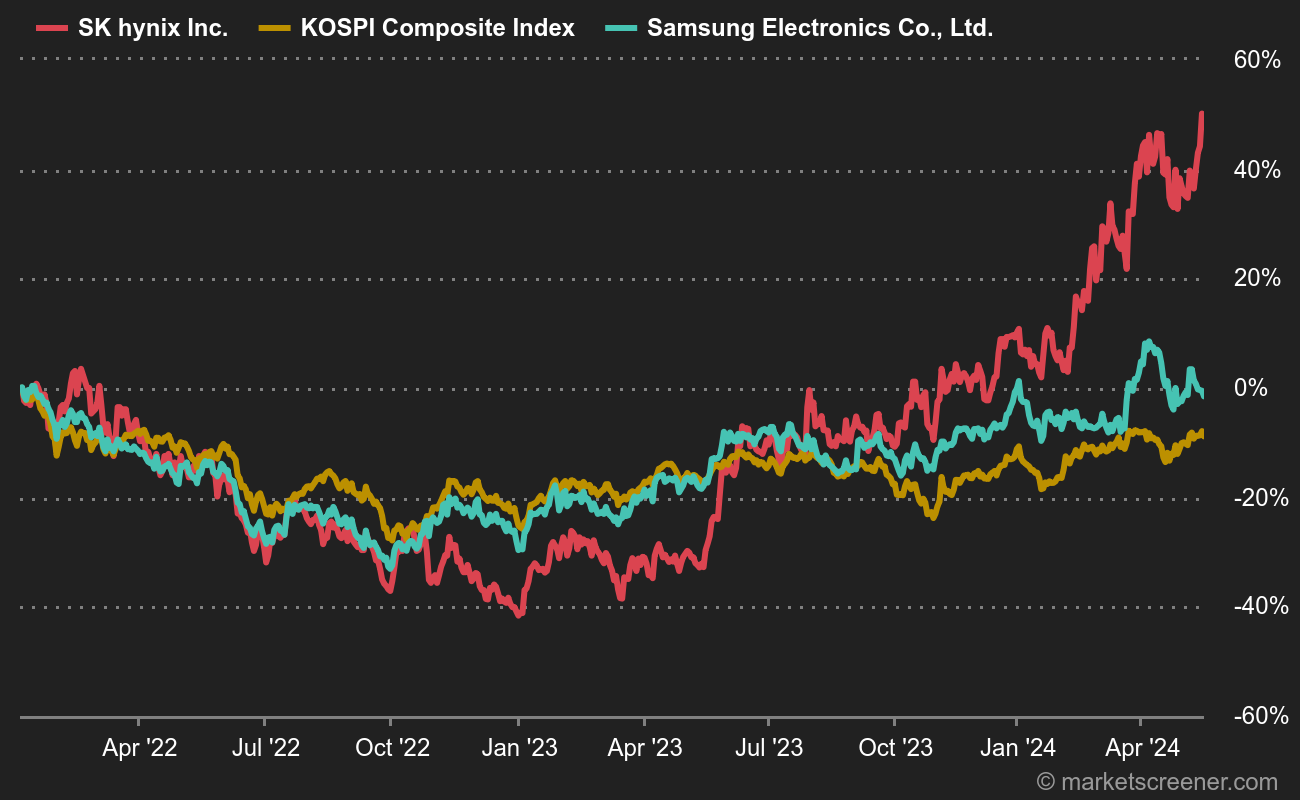

Kospi Composite, can chips save the Korean stock market?

For a long time, South Korea's growth has been underpinned by its very strong industrial dynamism, but since 2021 it has been running out of steam. The country's major manufacturers are struggling to keep pace with the massive investments being made in neighboring China, and local technology champions are falling behind the American giants. As a result, Seoul's flagship index, the Kospi, is experiencing a lasting slowdown.

Rising labor costs, a growing middle class, weak demographics, obsolete energy production and an attachment to old industrial models have all taken their toll on the country's manufacturing strength. A lack of innovation, outside the chip and IT sectors, has undermined the country's superb reputation.

Even the behemoths Samsung Electronics, LG and SK Hynix now fear for their future, and are appealing for financial reinforcements from the government to preserve their position and technological lead. But, on their own, they cannot save a faltering economy that lacks fundamental reforms. After boasting growth in excess of 6% for 50 years, Korea has been forced to get used to normalized rates of around 2%, which are in constant decline.

Composed of over 800 stocks, the KOSPI Composite is heavily weighted towards industrial and technology stocks, followed at the margins by healthcare companies, banks and consumer goods distributors.

By

By