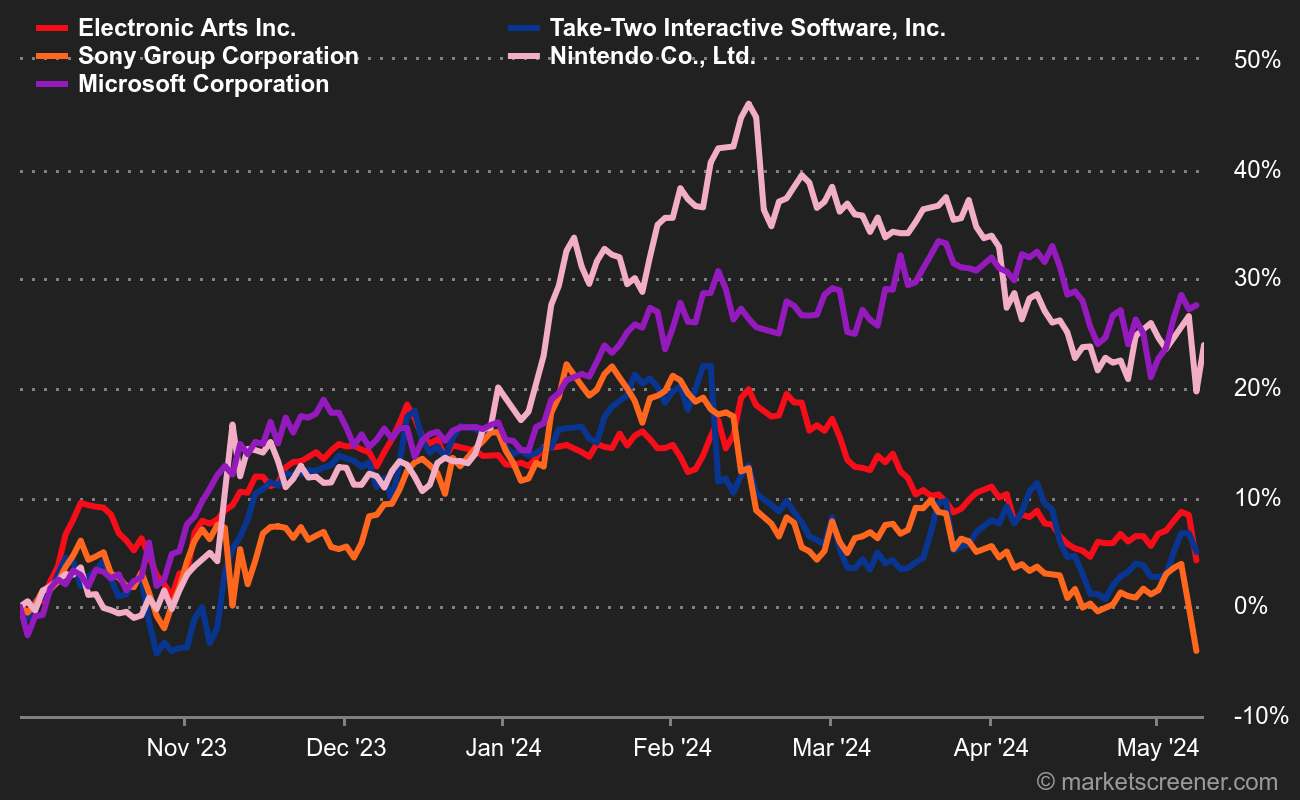

Game consoles are facing competition from online games, smartphones and virtual reality headsets, and are further weakened by the drop in demand since the end of the pandemic (which had caused home entertainment needs to explode). They're also penalized by relative maturity in their markets, by delays in the launch of new products, and by the fact that the market for video games is still relatively mature. Let's not forget delays in device releases and the absence of new flagship titles and successful franchises: the industry's sales are suffering a noticeable slowdown.

Sony has revised its sales forecasts for the Playstation 5 downwards (to 21 million for the year instead of the 25 million initially forecast), Microsoft is looking for growth drivers by pushing its games onto competing media since the XBox Series is no longer appealing, Electronic Arts' latest revenues have disappointed. Take-Two Interactive anticipates lower-than-expected quarterly sales, and rumors are swirling that the Switch2 launch will be postponed until 2025, while Nintendo has also just announced a slight quarterly decline in Switch1 sales.

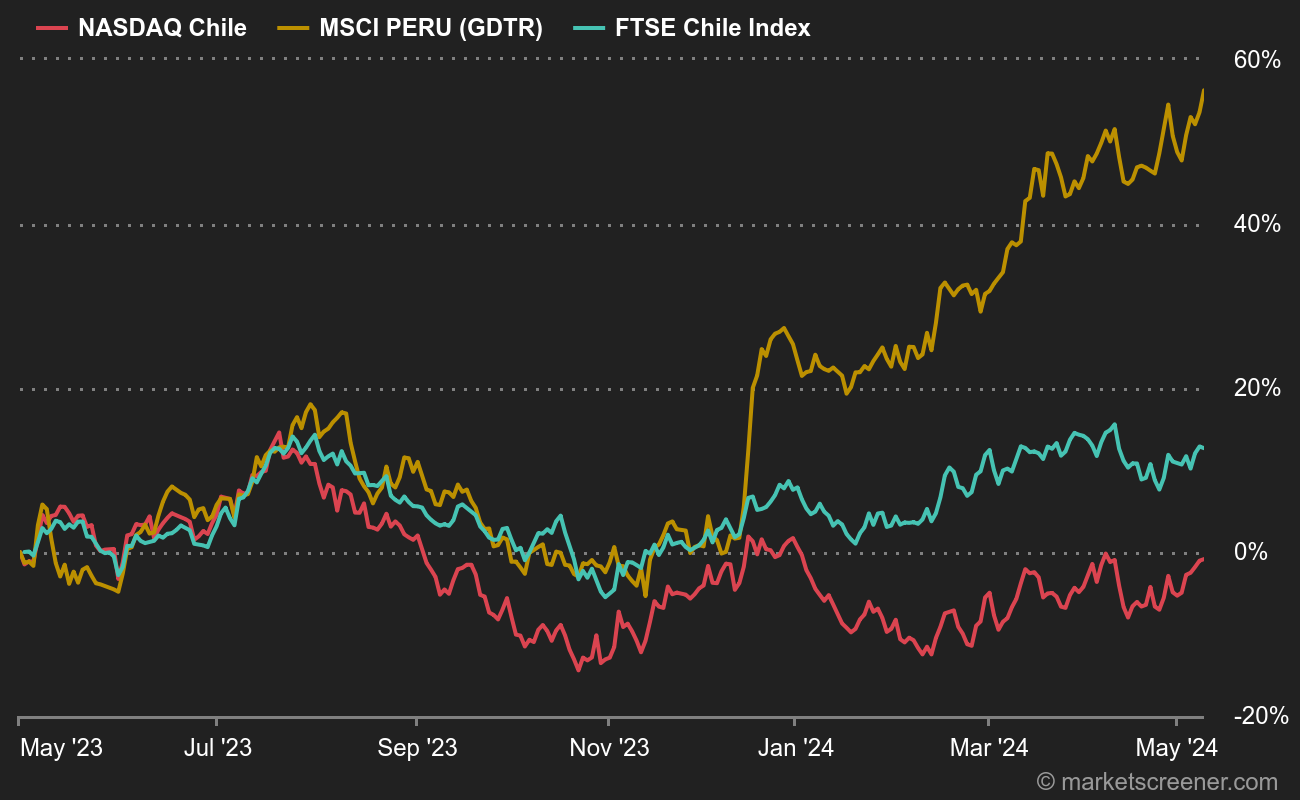

Peru and Chile lead the way!

In this week's rankings, three South American indices take the podium in terms of 5-day variations: MSCI Peru, Nasdaq Chile & FTSE Chile, with respectively, at the time of writing, +7%, +5% and +4.3%.

In Chile, the Santiago stock market, the continent's 3rd-largest, reflects the country's steady economic improvement and foreign investors' renewed attraction to its relative stability. Heavily weighed down by mining stocks, the market is benefiting from the sector's concerns about tightening copper supplies, and from the race for lithium supplies, despite the recent fall in the price of the metal useful for the energy transition. A similar situation prevails in Peru, where the mining sector accounts for half of Lima's stock market.

By

By