François Rochon, founder of asset management company Giverny Capital, began his career in telecommunications engineering before turning to finance. His talent for investing was revealed as early as high school, when he achieved a 54% return in a stock market competition.

Inspired by renowned investors such as Warren Buffett, he taught himself finance and adopted an investment approach based on fundamental analysis, focusing on quality companies with sustainable competitive advantages.

He began managing private portfolios in 1993, and founded Giverny Capital in 1998 after obtaining his portfolio management license in 1997.

Over the years, François Rochon has published annual letters, much as Warren Buffett does with Berkshire Hathaway.

François Rochon began his annual letter by taking stock of 2023. He reviewed the performance of North American stock markets, which had exceeded the expectations of even the most optimistic economists. The much-heralded recession has not (yet) taken place. This reinforces his view that it is dangerous to predict the future in order to obtain stock market returns: "In the world of stock market predictions, agnosticism is a source of more wealth creation than dogmatism."

François Rochon returned to the topics that made headlines in 2023, notably artificial intelligence: "It was more than ever in the news in 2023, both in terms of generative AI engines (Google's Gemini and OpenAI's ChatGPT) and the powerful servers and multiprocessors required to use AI." Mr. Rochon points out that AI equipment suppliers have rather cyclical revenues, which we shouldn't forget: "We have to realize that AI server equipment companies are benefiting from an explosion in capital expenditure (on the part of companies like Facebook, Microsoft, Amazon and Google). This spending will not necessarily be of an ever-recurring nature in the future."

The performance of US indices has been strongly driven by the explosion of the Magnificent 7: Apple, Microsoft, Amazon, Alphabet, Nvidia, Tesla and Meta Platforms. All this led to a hyper-concentration of the main US indices, the S&P 500 and Nasdaq 100, around the Magnificent 7: "These seven S&P 500 stocks achieved a weighted return of 87%, contributing 16% of the 26% return of the index (including dividends). This means that all the other 493 stocks in the S&P 500 returned 10% (including dividends). Thus, the S&P 500's performance was highly polarized and not a fair reflection of the performance of all U.S. stocks."

He also paid tribute to his friend Charlie Munger, Warren Buffett's sidekick at the helm of Berkshire Hathaway: "For me, Charlie was the triumph of erudition, rationality and candor."

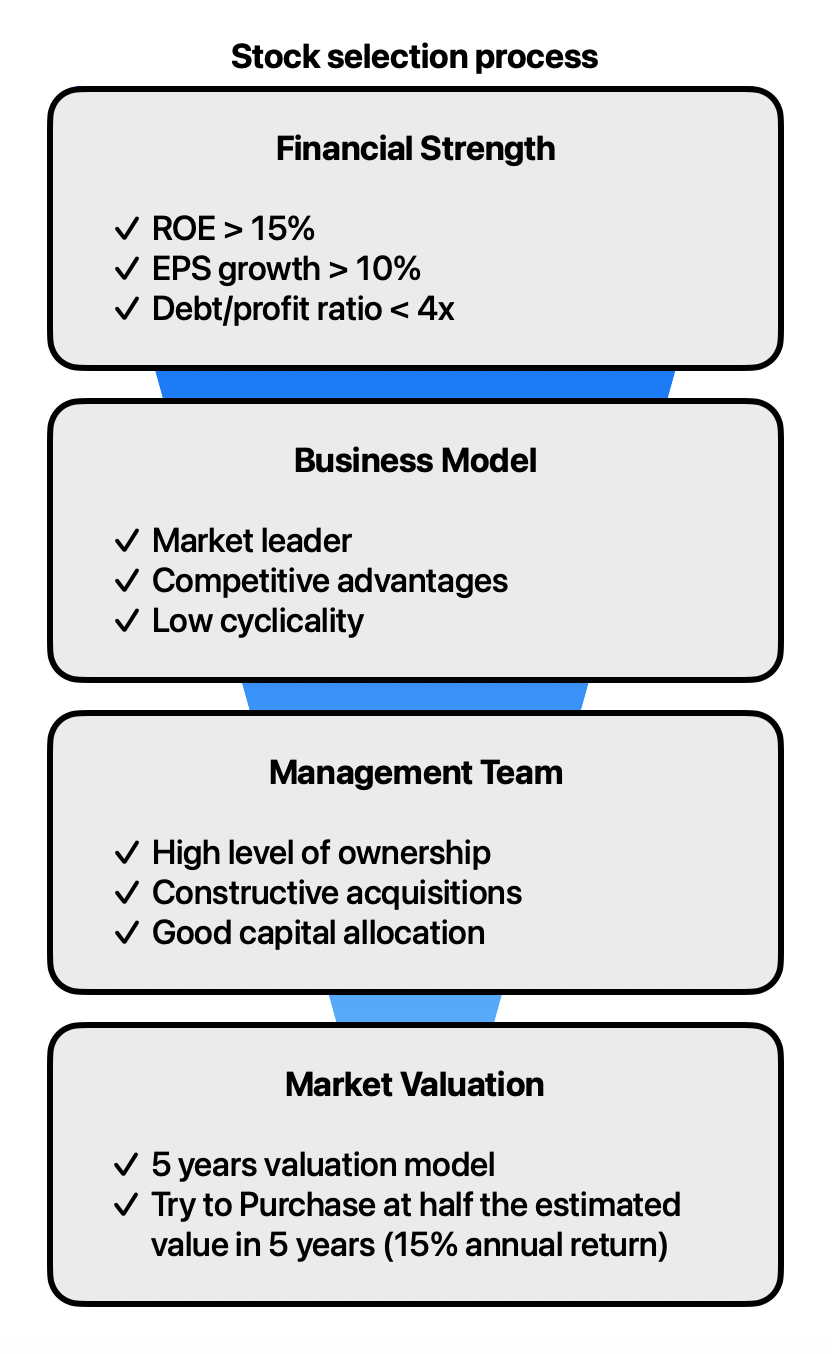

Investment philosophy at Giverny Capital

Giverny Capital currently manages over two billion dollars. Its investment philosophy is akin to that of the post-1972 Warren Buffett. At that time, the oracle of Omaha shifted from a "value" investor close to the concepts of Benjamin Graham to a more "quality" style under the influence of Charlie Munger. This idea that the quality of a company ultimately outweighs its valuation is shared by François Rochon.

The manager of Giverny Capital is convinced that equities are the best investment class (and rightly so, if past performance is anything to go by). In his view, it is futile to predict when the best time to enter (or exit) the stock market will be. He chooses companies with a high level of profitability, good long-term growth prospects and honest, competent management dedicated to the good of shareholders. On the other hand, he avoids companies that are risky, unprofitable, over-indebted, cyclical and/or run by people motivated by ego rather than genuine stewardship. Once a company has been selected for its outstanding qualities, a realistic assessment of the company's intrinsic value is made.

Here's a simplified outline of the selection process at Giverny Capital:

After 30 years of portfolio management, here are their performances:

- Global portfolio 14.8% p.a. since 1993 (outperforming its hybrid benchmark of S&P/TSX, S&P 500, Russell 2000, MSCI EAFE by 5.5% p.a.);

- US portfolio 14.0% p.a. since 1993 (outperforming its S&P 500 benchmark by 3.9% p.a.);

- Canada portfolio 16.7% p.a. since 2007 (outperforming its S&P/TSX benchmark by 10.7% p.a.).

François Rochon reminds us of the obvious correlation between earnings growth and share price growth. Since 1996, the Rochon Global portfolio has appreciated by 12.9% per annum, and earnings by 12.9% per annum. A synchronicity that will come as no surprise to long-term investors.

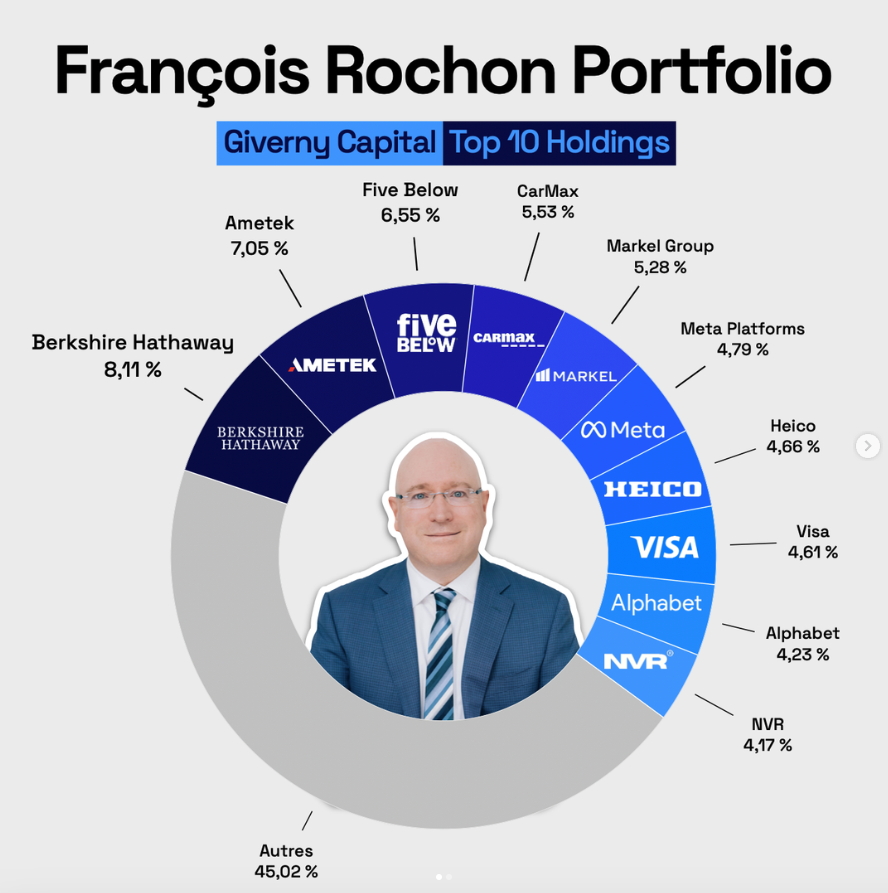

Here are the top 10 holdings in his US portfolio:

François Rochon likes to take stock of his five-year post-mortem investments. For the 2023 letter, he looks back at his 2018 investments, in which he acquired Meta Platforms, Charles Schwab and NVR, among others. EPS have appreciated by 14%, 5% and 19% respectively per annum since 2018 for these three companies (representing an average CAGR of 13%). At the same time, their shares have appreciated at a rate of 22%, 11% and 23% per year respectively over the same period (i.e. an average CAGR of 19%). All in all, rather good investments, even if the Charles Schwab stock was disappointing.

Another section much appreciated by readers of his letters is the podium of his mistakes. In keeping with Giverno tradition, he awards three medals for his "best" mistakes of 2023 (or previous years). This time, he takes on Brown & Brown, Chipotle Mexican Grill and Novo Nordisk.

The Quebec-based manager was a shareholder in insurance brokerage Brown & Brown from 2004 to 2009. Disappointed with founder Hyatt Brown's succession plan and stagnating profits post-subprime crisis, he sold his position in 2009. Although profits stagnated until 2013, they recovered from 2013 to 2023, with an annualized EPS growth rate of 14%. The stock has continued to appreciate to date at a rate of 16% per year, rising from $14 in 2013 to $71 at the end of 2023. The lesson here is that you should always continue to follow the stocks you've sold. The companies in our portfolios will inevitably experience slumps, but nothing is definitive.

Mr. Rochon tested the Mexican fast-food chain Chipotle Mexican Grill in 2007, and particularly enjoyed the experience. Sales rose from $1 billion to $4.5 billion between 2007 and 2015, and EPS from $2 to $15. Following a food crisis in 2015, the stock fell by half, and this was a great opportunity to invest, because although the company would slowly recover, it would surely return to its former profitability within a few years. But despite his conviction, Mr. Rochon missed the opportunity. He had a second chance in March 2020 with the Covid-19 pandemic, but he too passed. The lesson here is that, once you've analyzed the situation objectively, if you assess a stock's strong upside potential for a measured risk, you sometimes have to force yourself to take action.

His gold medal goes to Novo Nordisk, a company he has been following since 1998. The stock has appreciated by 20% a year since then, and has become a 100-bagger in 25 years. The Quebec manager even visited the company's headquarters in Copenhagen in 2014 and saw the extent of Novo Nordisk's competitive advantages. François Rochon has always found the share price too expensive. The lesson is that it's sometimes better to pay a little more for quality, that it's better to buy an extraordinary company at an ordinary price, than an ordinary company at an extraordinary price.

Despite these few mistakes, François Rochon is a talented manager. Thanks to his humility and transparency, he allows us to put our own mistakes into perspective. Even the greatest managers make mistakes, but that doesn't stop them from achieving great results. The important thing is to avoid repeating them and to keep learning.

To find out more, read the Giverny Capital letters here.

By

By