Block 1: Key news

Changpeng Zhao soon in prison?

Changpeng Zhao, the former CEO of Binance, will soon be sentenced after pleading guilty to charges of facilitating money laundering and violating the Bank Secrecy Act in the USA. The verdict, expected on April 30, could include a prison sentence, although the exact sentence is obviously still uncertain. At this stage, most experts close to the case agree that the former CEO could receive several months' imprisonment. In fact, the law provides for prison sentences of up to 10 consecutive years for the acts of which he is accused.

LBBW expands its crypto services

Landesbank Baden-Württemberg (LBBW), Germany's largest federal bank, in partnership with Bitpanda, has announced the launch of a cryptocurrency custody service for their corporate clients in particular. LBBW is offering an "investment-as-a-service" service for the storage and purchase of cryptocurrencies, which the company believes will meet the growing demand from its customers. The service will be available to corporate customers from the second half of 2024.

Sam Bankman-Fried appeals his conviction

Sam Bankman-Fried (SBF), founder of FTX, has appealed his 25-year prison sentence handed down by Judge Lewis Kaplan. The appeal was filed by his attorney in the U.S. District Court for the Southern District of New York. While the appeal could potentially reduce his sentence, there is also a risk that it could have the opposite effect, given that SBF originally faced up to 110 years in prison. Currently, SBF remains detained at the Metropolitan Detention Center in Brooklyn.

Block 2: Cryptic Analysis of the week

On Monday, Hong Kong's Securities and Futures Commission (SFC) granted licenses to asset managers including ChinaAMC, Harvest Global and Bosera International to launch spot ETFs on bitcoin (BTC) and ether (ETH), according to local sources. This is the latest sign of the institutionalization of major crypto-assets, and perhaps a harbinger of things to come in mainland China, which has banned virtually all crypto-asset-related activity in 2021.

The approval makes Hong Kong one of the pioneers in authorizing spot ether ETFs, after Canada, which was the first to approve bitcoin and, later, ether ETFs. The U.S. Securities and Exchange Commission has also approved, after some reluctance, bitcoin cash ETFs, but is dragging its feet on an ether ETF approval .

Globally, Europe, Singapore, Australia and Dubai have also authorized bitcoin ETFs, often on futures contracts or via baskets of shares in companies closely linked to the cryptosphere. The UK is expected to allow cryptocurrency trading on the London Stock Exchange from May, with Australia to follow in June.

Hong Kong's decision could catalyze similar action in Asia, bolstering its stature as a financial hub and potentially influencing neighboring markets, such as Japan and Singapore, to embrace one-off investments in bitcoin or ether. However, unlike the unblocking that occurred in the US, which was one of the main drivers of bitcoin's recent rally that pushed the asset to new all-time highs, there are reasons to doubt that billions of new capital will flow into the market.

While several bitcoin and ether futures exchange-traded funds (ETFs) were launched in Hong Kong in December 2022, their combined assets under managements reached just $170 million more than a year later, in stark contrast to the $2.8 billion in AUM of the largest U.S.-listed BTC futures ETF, ProShares' BITO.

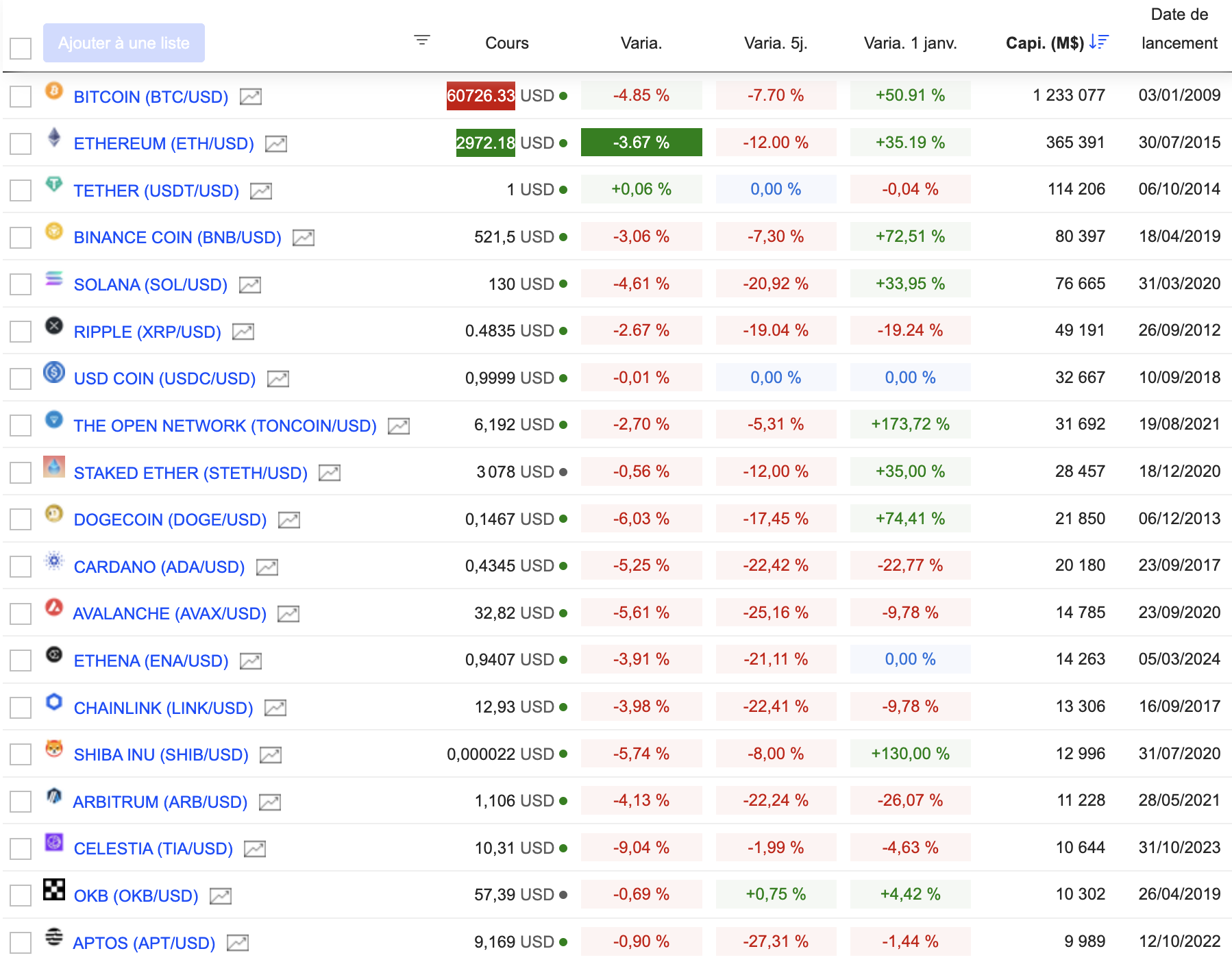

Block 3: Gainers & Losers

Crypto chart (Click to enlarge)

Block 4 : This week's readings

Crypto FOMO is back. So are the scams (Wired)

Bitcoin's halving is coming. Miners look for new ways to make money (WSJ).

Rights, Reason, Revolution: Washington at the Bitcoin Political Summit (Bitcoin Magazine)

By

By