Block 1: Essential news

- El Salvador: A first bitcoin-backed bond

El Salvador has received approval to issue the first bitcoin-backed bonds (BTC), known as "Volcano bonds", scheduled for the first quarter of 2024. This initiative, approved by the National Commission of Digital Assets (CNAD), aims to raise at least one billion dollars, in order to increase the country's BTC reserves. The bonds, which forecast an annual return of 6.5% over 10 years, are part of a series of pro-BTC initiatives by El Salvador, including a Bitcoin education program and a citizenship visa for investors willing to invest $1 million in the form of USDT bitcoins or stablecoins.

- Binance VS SEC: the battle goes on

Binance and its former CEO, Changpeng Zhao, have sent a letter to the SEC, requesting an oral hearing to dispute the fraud charges and question the SEC's authority in regulating cryptocurrencies. Binance is challenging the SEC's lack of precedent and current interpretation of the securities laws, arguing that cryptocurrency transactions are not akin to the sale of financial securities. Furthermore, Binance defends Changpeng Zhao, claiming that there is insufficient evidence to justify legal action against him. To be continued.

- Sam Bankman-Fried was "indefensible".

Sam Bankman-Fried, founder of FTX, is involved in a lawsuit described by his lawyer, David Mills, as "almost impossible to win". Mills, who agreed to represent Bankman-Fried pro bono out of friendship for his parents, spoke of the difficulties of defending SBF, not least because of guilty pleas from his former collaborators. He criticized SBF's attempts to defend himself and his inability to follow legal advice, calling him "the worst person he had ever seen cross-examine". Mills also revealed that he would not be participating in SBF's appeal, the verdict for which will be handed down on March 28, 2024.

- Discover Donald Trump's latest NFT folly

Donald Trump has launched his third NFT collection, dubbed the "Mugshot Edition", in a nod to the former US president's legal troubles. The collection, which includes merchandise such as mugs and t-shirts, offers buyers of 47 NFTs dinner with the former president at his Mar-a-Lago residence and a piece of his suit worn for his mugshot when he was arrested in August. The NFTs, priced at $99 each, are part of a series of digital collections offered by Trump, who, despite his initial hostility towards cryptocurrencies during his time in office, appears to have invested in the sector since leaving the Oval Office, given that he owns an Ethereum wallet.

https:// t.co/0TJzDIcOBP

Watch This Video: Don't Miss Out! pic.twitter.com/vunSPlEY6Z

- CollectTrumpCards (@CollectTrump) December 12, 2023

Block 2: Cryptic Analysis of the week

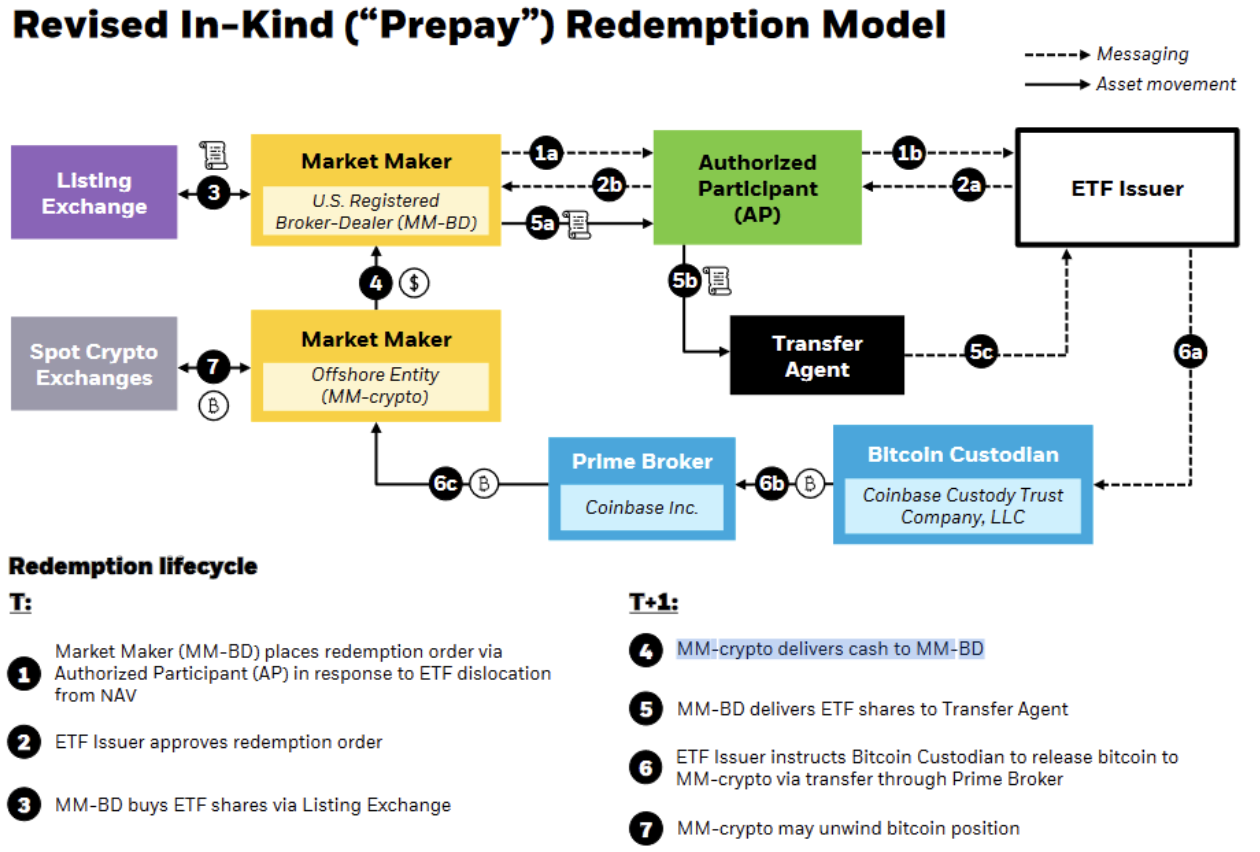

BlackRock has updated its application to create an exchange-traded fund (ETF) for bitcoin spot, introducing a new model designed to facilitate the participation of Wall Street banks, which is an important development for the financial sector, and by extension for cryptocurrencies.

This revised ETF model allows banks to create new shares using dollar liquidity, which is a departure from the previous cryptocurrency-only approach. More specifically, this strategy enables "authorized participants" (APs), in this case banks, to transfer liquiditys to a broker, who then converts them into bitcoins and stores them with the ETF's custodian, Coinbase Custody in BlackRock's case.

This amendment to facilitate the participation of major banks such as JPMorgan and Goldman Sachs - companies with some of the world's largest balance sheets - takes into account the restrictions that prevent these institutions from directly holding bitcoin or other cryptocurrencies on their balance sheets.

BlackRock's innovative approach, dubbed the "Prepaid" In-Kind Repayment Model, was detailed in a recent reunion with the US Securities and Exchange Commission (SEC) on November 28, attended by six representatives from BlackRock and three from Nasdaq.

According to BlackRock, the revised ETF structure shifts risk from "authorized participants" to market makers, while pretending to offer greater resistance to market manipulation - a key concern historically cited by the SEC in rejecting spot Bitcoin ETFs until now. BlackRock claims that this model not only enhances investor protection, but also reduces transaction costs and increases cohesion within the Bitcoin ETF industry.

The group continued dialogue with the SEC, culminating in a third meeting on December 11, underscores its unwavering commitment to this initiative. Other industry behemoths, such as Fidelity, Grayscale Investment and Franklin Templeton, have also met with the SEC over the past two weeks to discuss their Bitcoin ETF filings, according to notes reviewed by Bloomberg ETF analyst James Seyffart.

Nothing groundbreaking to report but 4 different issuers have met with the SEC regarding their #Bitcoin ETF filings in last few days. @BlackRock met with them yesterday for the third time in as many weeks. While @Grayscale, Franklin, and @Fidelity each had meetings last week pic.twitter.com/5gwBk83m0o

- James Seyffart (@JSeyff) December 12, 2023

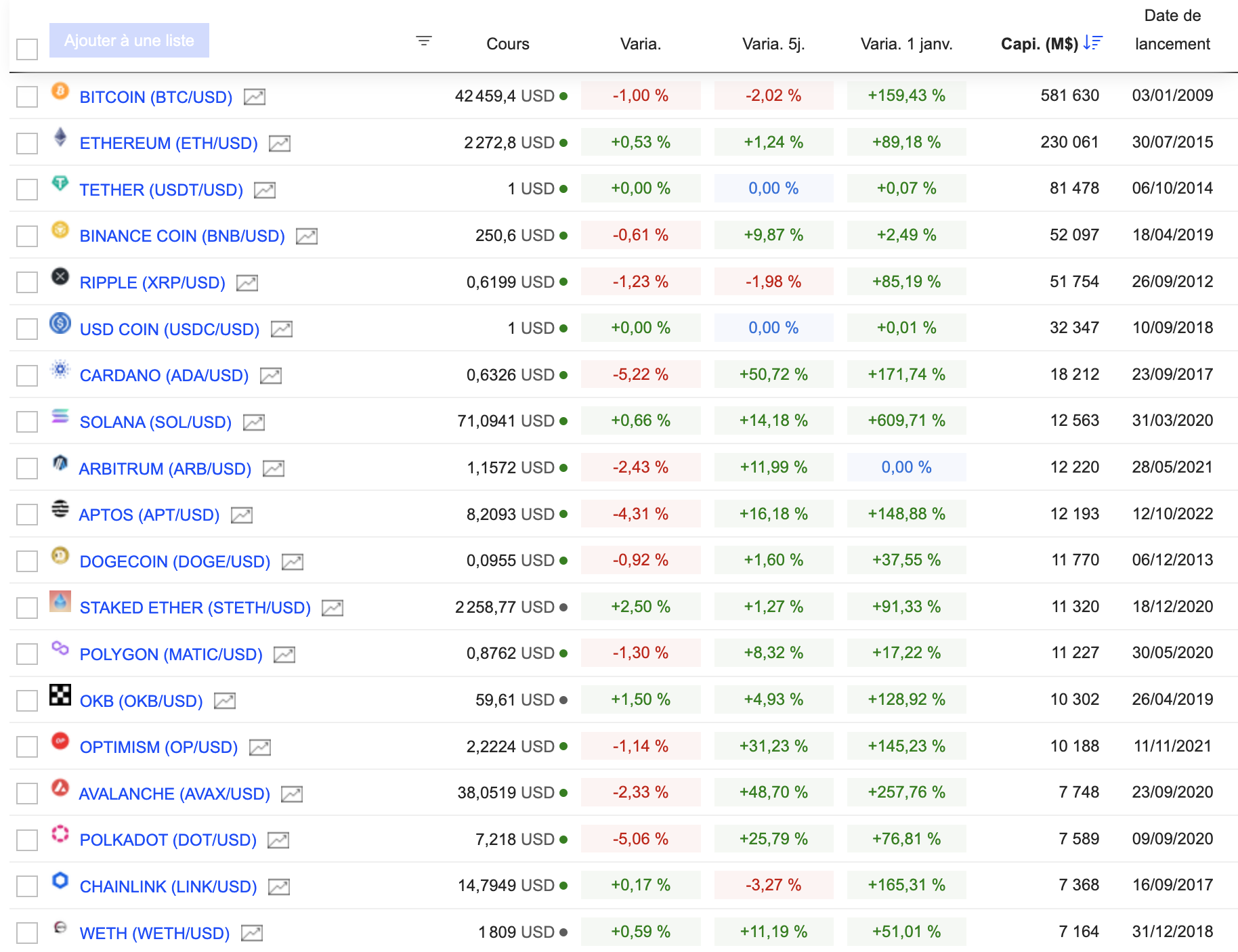

The financial community is eagerly awaiting the SEC's decision, expected between January 5 and 10, on several pending Bitcoin ETF applications, including those from Grayscale, Bitwise, VanEck and others. The deadline for a final decision on BlackRock's application is March 15.

Block 3: Gainers & Losers

Block 4: Things to read

A farewell to cash (Project Syndicate)

FTX customers fight for what's left of their crypto (WSJ)

Bitcoin fluctuates amid growing institutional acceptance (Bitcoin Magazine)

By

By